[ad_1]

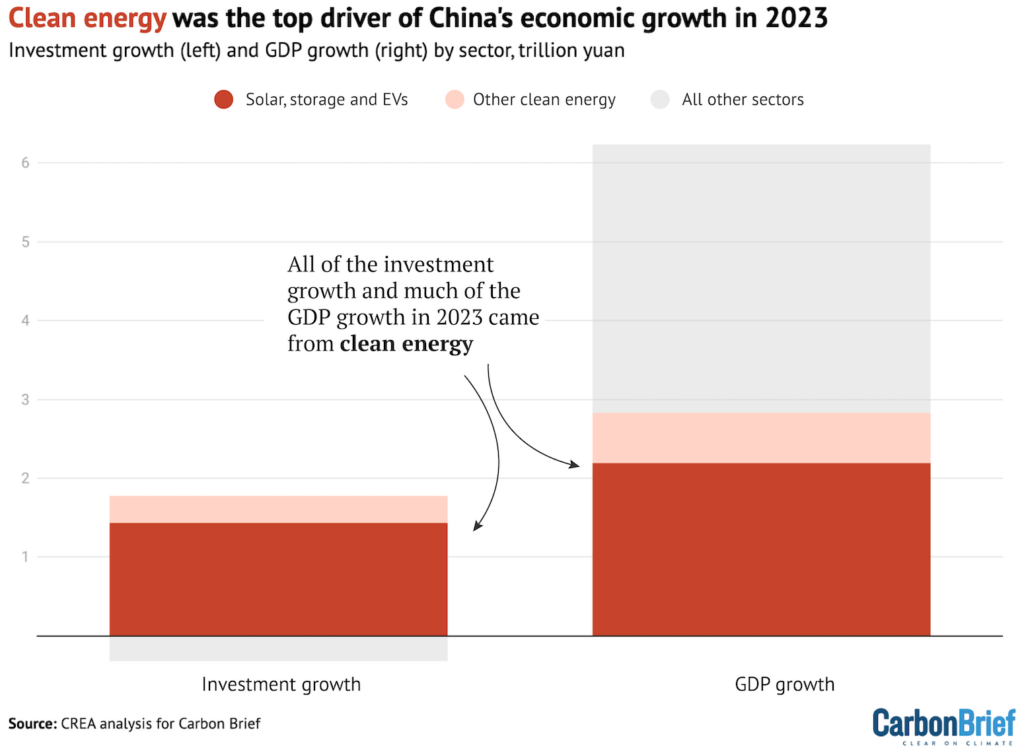

Clear vitality contributed a file 11.4tn yuan ($1.6tn) to China’s financial system in 2023, accounting for all the development in funding and a bigger share of financial development than another sector.

The brand new sector-by-sector evaluation for Carbon Transient, based mostly on official figures, business information and analyst stories, illustrates the large surge in funding in Chinese language clear vitality final 12 months – particularly, the so-called “new three” industries of solar energy, electrical autos (EVs) and batteries.

Solar energy, together with manufacturing capability for photo voltaic panels, EVs and batteries, have been the primary focus of China’s clean-energy investments in 2023, the evaluation exhibits.

(For this evaluation, we used a broad definition of “clear vitality” sectors, together with renewables, nuclear energy, electrical energy grids, vitality storage, EVs and railways. These are applied sciences and infrastructure wanted to decarbonise China’s manufacturing and use of vitality.)

Different key findings of the evaluation embrace:

Clear-energy funding rose 40% year-on-year to six.3tn yuan ($890bn), with the expansion accounting for all the funding development throughout the Chinese language financial system in 2023.

China’s $890bn funding in clean-energy sectors is sort of as massive as complete world investments in fossil gasoline provide in 2023 – and much like the GDP of Switzerland or Turkey.

Together with the worth of manufacturing, clean-energy sectors contributed 11.4tn yuan ($1.6tn) to the Chinese language financial system in 2023, up 30% year-on-year.

Clear-energy sectors, consequently, have been the most important driver of China’ financial development total, accounting for 40% of the enlargement of GDP in 2023.

With out the expansion from clean-energy sectors, China’s GDP would have missed the federal government’s development goal of “round 5%”, rising by solely 3.0% as an alternative of 5.2%.

The surge in clean-energy funding comes as China’s real-estate sector shrank for the second 12 months in a row. This shift positions the clean-energy business as a key half not solely of China’s vitality and local weather efforts, but in addition of its broader financial and industrial coverage.

Nevertheless, the spectre of overcapacity means China’s clean-energy funding development – and its investment-driven financial mannequin, generally – can’t proceed indefinitely.

The rising significance of those new industries provides China a big financial stake within the world transition to clean-energy applied sciences.

But it additionally poses questions for abroad policymakers making an attempt to tie their very own local weather methods to home industrial development.

Clear vitality drives China’s development in 2023

China’s clean-energy funding growth means the sector accounted for all the development in funding throughout the nation’s financial system in 2023, with spending in different areas shrinking.

China invested an estimated 6.3tn yuan ($890bn) in clean-energy sectors in 2023, up from 4.6tn yuan in 2022, a 1.7tn yuan (40%) year-on-year enhance. In complete, clear vitality made up 13% of the large quantity of funding in fastened belongings in China in 2023, up from 9% a 12 months earlier.

With Chinese language funding rising by simply 1.5tn yuan in 2023 total, the evaluation exhibits that clear vitality accounted for all the development, whereas funding in sectors akin to actual property shrank.

That is proven within the determine beneath, which additionally highlights the focus of clean-energy funding within the so-called “new three” of photo voltaic, vitality storage and EVs.

Clear vitality was additionally the highest contributor to China’s financial development total, contributing round 40% of the year-on-year enhance in GDP throughout all sectors.

Together with the worth of products and companies, the clean-energy sector contributed an estimated 11.4tn yuan ($1.6tn) to China’s financial system in 2023, a rise of 30% year-on-year.

This implies clear vitality accounted for 9.0% of China’s GDP in 2023, up from 7.2% in 2022.

With out the contribution of clean-energy sectors to China’s financial development in 2023, the nation would have seen its GDP rise by simply 3.0%, as an alternative of the 5.2% really recorded.

This could have missed authorities development targets at a time of accelerating considerations over the nation’s financial prospects, amid the continued real-estate disaster and declining inhabitants.

The most important position that clear vitality performed in boosting development in 2023 means the business is now a key a part of China’s wider financial and industrial improvement.

That is prone to bolster China’s local weather and vitality insurance policies – in addition to its “twin carbon” targets for 2030 and 2060 – by enhancing the financial and political relevance of the sector.

Again to high

The ‘new three’ dominate clean-energy funding

This evaluation is predicated on a mix of presidency releases, business information and analyst stories, with the precise methodology various sector-by-sector, as set out within the sections that observe.

The desk beneath lists the estimated contributions of every sector to Chinese language funding and GDP total in 2023, in addition to the year-on-year development since 2022.

The evaluation consists of photo voltaic, EVs, vitality effectivity, rail, vitality storage, electrical energy grids, wind, nuclear and hydropower inside the broad class of “clean-energy sectors”. All of those are applied sciences and infrastructure wanted to decarbonise China’s vitality provide and consumption.

The so-called “new three” of photo voltaic, storage and EVs are all outstanding within the desk – and all recorded robust development.

Our evaluation exhibits that funding in clear energy era and vitality storage capability reached 1.7tn yuan in 2023 (up 48% year-on-year), whereas funding in manufacturing capability for photo voltaic, EVs and batteries reached 2.5tn yuan (+60%).

Funding in clean-energy infrastructure reached 1.4tn yuan (+9%, comprising grids, EV charging factors and railways) and funding in vitality effectivity was 600bn yuan (+15%).

In the meantime, our evaluation exhibits the worth of manufacturing of products and companies within the clean-technology sectors reached 5.1tn yuan in 2023, rising 26% year-on-year.

This consists of the worth of electrical energy era, EV gross sales and photo voltaic exports, in addition to the transport of passengers and items through rail.

SectorActivityValue in 2023, CNY blnValue in 2023, USD blnYear-on-year development

Photo voltaic powerInvestment: energy era capacity75510761%

Photo voltaic powerInvestment: manufacturing capacity922131180%

Photo voltaic powerElectricity generation2773945%

Photo voltaic powerExports of components5337542%

EVsInvestment: manufacturing capacity1,25017735%

EVsInvestment: charging infrastructure1021433%

EVsProduction of vehicles2,20031130%

Vitality efficiencyInvestment: Industry5858314%

Rail transportationInvestment7611087%

Rail transportationTransport of passengers and goods96413639%

Vitality storageInvestment: Pumped hydro3344738%

Vitality storageInvestment: Electrolyzers881285%

Vitality storageInvestment: Battery manufacturing31745116%

Vitality storageInvestment: Grid-connected batteries7511364%

Energy gridInvestment: transmission capacity540768%

Wind powerInvestment: energy era capability, onshore3304785%

Wind powerInvestment: energy era capability, offshore721017%

Wind powerElectricity generation3635112%

Nuclear powerInvestment: energy era capacity871245%

Nuclear powerElectricity generation195284%

HydropowerInvestment: energy era capacity8011-1%

HydropowerElectricity generation51272-6%

TotalInvestments6,29789139%

TotalProduction of products and services5,08271926%

TotalTotal GDP contribution11,3791,61033%

Again to high

Solar energy

Photo voltaic was the most important contributor to development in China’s clean-technology financial system in 2023. It recorded development price a mixed 1tn yuan of recent funding, items and companies, as its worth grew from 1.5tn yuan in 2022 to 2.5tn yuan in 2023, a rise of 63% year-on-year.

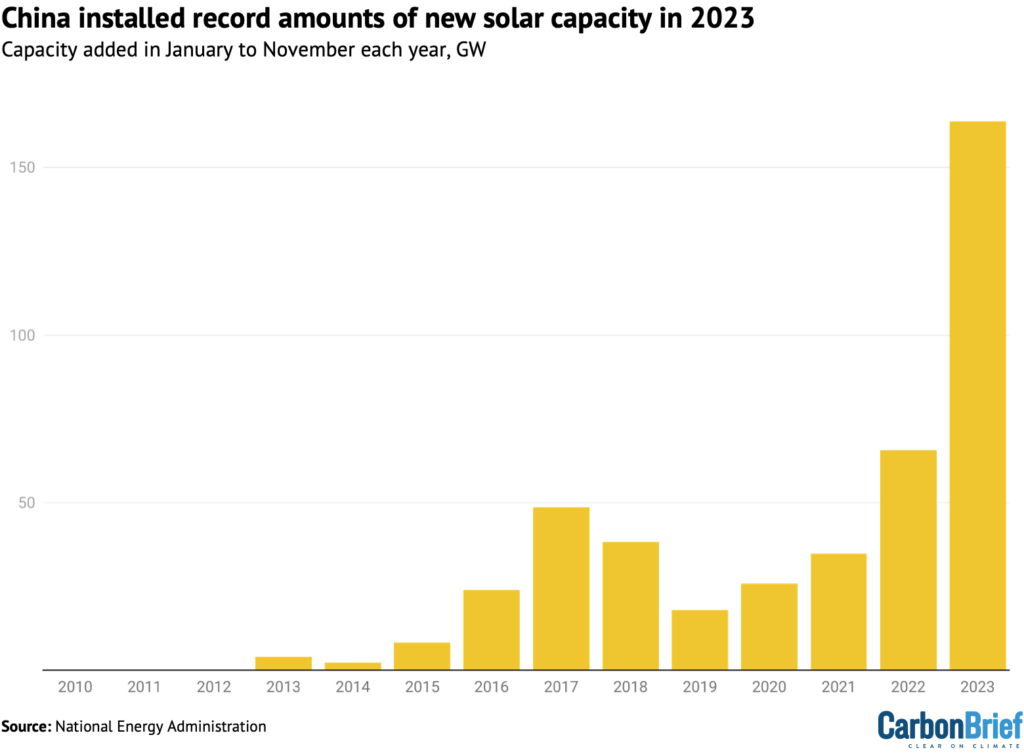

Whereas China has dominated the manufacturing and installations of photo voltaic panels for years, the expansion of the business in 2023 was unprecedented.

On the set up aspect, two main central authorities initiatives drove elevated volumes, specifically the “whole-county distributed photo voltaic” and the “clear vitality base” programmes.

As well as, in response to the slowdown within the real-estate sector, the central authorities launched a brand new coverage at first of 2023, to encourage the event of solar energy industries on unused and present building lands.

In the meantime, throughout the annual legislative conferences within the spring of 2023, 15 provinces prioritised photo voltaic business improvement of their authorities work agendas.

Detailed information on the expansion in China’s photo voltaic installations within the first 11 months of the 12 months is proven within the determine beneath. (An estimated 200GW was added throughout the nation throughout 2023 as a complete, greater than doubling from the file of 87GW set in 2022.)

On the identical time, China’s photo voltaic manufacturing business recorded even stronger development in 2023. China added 340 gigawatts (GW) of polysilicon manufacturing capability and 300GW of wafer, cell and module manufacturing capability in 2023, in keeping with the Worldwide Vitality Company (IEA).

China skilled a big enhance in photo voltaic product exports in 2023. It exported 56GW of photo voltaic wafers, 32GW of cells and 178GW of modules within the first 10 months of the 12 months, up 90%, 72% and 34% year-on-year respectively, in keeping with the China Photovoltaic Business Affiliation. Nevertheless, attributable to falling prices, the export worth of those photo voltaic merchandise solely elevated by 3%.

Inside the total export development there have been notable will increase in China’s photo voltaic exports to international locations alongside the “belt and highway”, to southeast Asian nations and to a number of African international locations.

For this evaluation, the worth of investments in new photo voltaic manufacturing capability was estimated from the typical capital prices of every step within the provide chain, taken from a compilation of reported undertaking prices. This gave a considerably decrease price degree than reported in different literature.

The evaluation assumes that native authorities funding in services and infrastructure, in addition to direct subsidies, added 30% to the reported personal funding.

Funding in solar energy was estimated by multiplying the newly added capability from Bloomberg New Vitality Finance by the unit funding prices for rooftop and utility-scale techniques from China Photovoltaic Business Affiliation.

The worth of exported solar energy gear was based mostly on China Photovoltaic Business Affiliation information for 2022 and reported export development for 2023.

The worth of solar energy gear produced for home set up was not included in our evaluation, to keep away from overlap with the already-estimated funding prices for home photo voltaic tasks.

Again to high

Wind energy

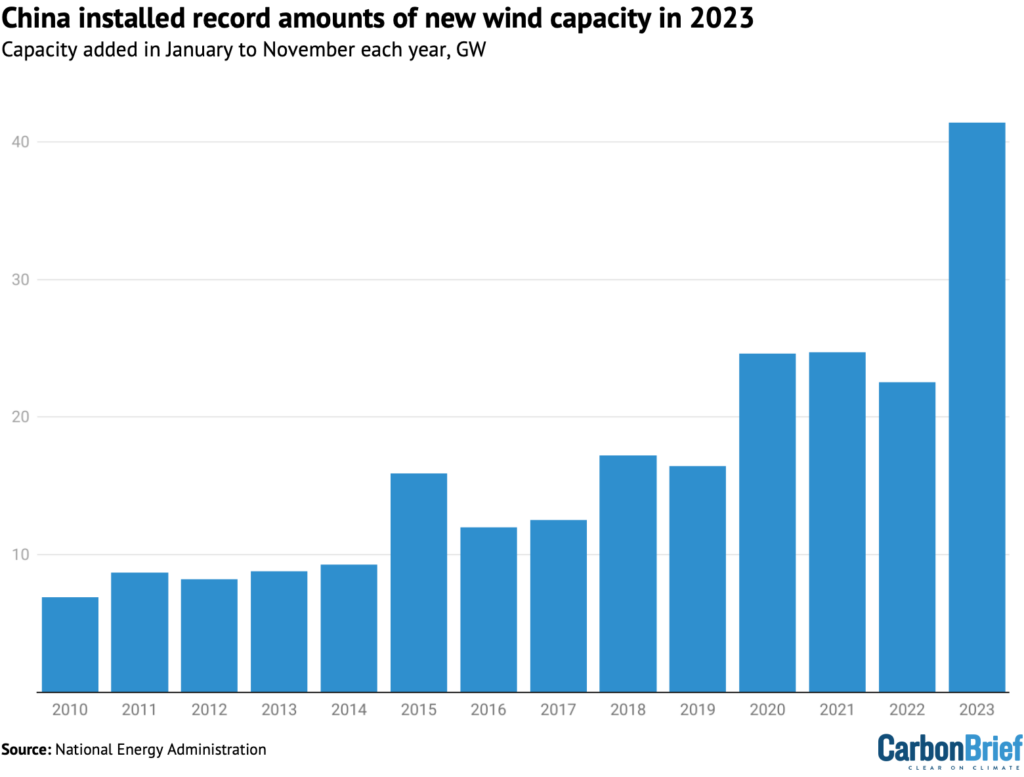

China put in 41GW of wind energy capability within the first 11 months of 2023, a rise of 84% year-on-year in new additions. Some 60GW of onshore wind alone was attributable to be added throughout 2023, in keeping with China Galaxy Securities, based mostly on tendencies in earlier years.

As well as, offshore wind capability elevated by 6GW throughout the entire of 2023.

Wind capability added within the first 11 months of every 12 months is proven within the determine beneath.

By the tip of 2023, the primary batch of “clean-energy bases” have been anticipated to have been related to the grid, contributing to the expansion of onshore wind energy, notably in areas akin to Inside Mongolia and different northwestern provinces. The second and third batches of clean-energy bases are set to proceed driving the expansion in onshore wind installations.

The market can also be being pushed by the “repowering” of older windfarms, supported by central authorities insurance policies selling the mannequin of changing smaller, older generators with bigger ones.

The potential for distributed wind energy can also be being explored, with initiatives such because the “villages wind utilisation motion” being deliberate for lively implementation.

Progress on offshore wind energy building in 2023 obtained off to a sluggish begin. This can be a reflection of a shift from nearshore to deeper offshore tasks and from single tasks to bigger bases.

Offshore wind tasks are additionally dealing with complicated approval processes, involving a number of regulatory elements, resulting in uncertainties and slower-than-expected installations.

Nevertheless, these points are being addressed and the fourth quarter of 2023 noticed a rebound in offshore wind building, with 2024 anticipated to be a big 12 months for undertaking deliveries.

Since 2021, new wind tasks in China not obtain subsidies from the central authorities.

Regardless of technological developments lowering prices, will increase in uncooked materials costs have resulted in decrease revenue margins in comparison with the photo voltaic business, resulting in a smaller total funding in wind energy relative to solar energy.

Again to high

Electrical autos

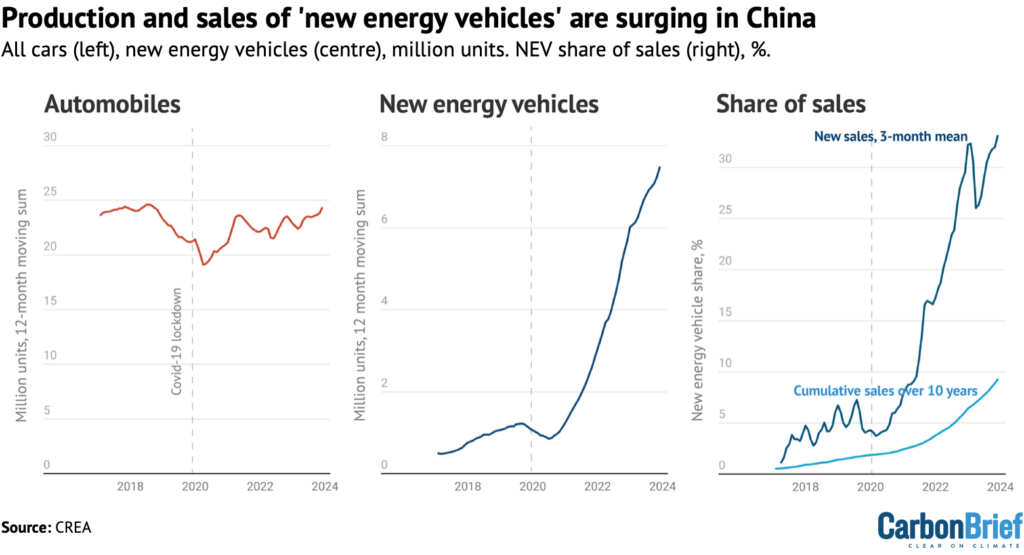

China’s manufacturing of electrical autos grew 36% year-on-year in 2023 to succeed in 9.6m models, a notable 32% of all autos produced within the nation.

The overwhelming majority of EVs produced in China are bought domestically, with gross sales rising strongly regardless of the phase-out of buy subsidies introduced in 2020 and accomplished on the finish of 2022.

The nationwide buy subsidy for EVs was a central authorities finance instrument that had been fostering the EV marketplace for 13 years. Its demise highlights a gradual shift from policy-driven to market-driven demand, making development extra prone to be sustained.

Gross sales of EVs made in China reached 9.5m models in 2023, a 38% year-on-year enhance. Of this complete, 8.3m have been bought domestically, accounting for one-third of Chinese language car gross sales total, whereas 1.2m EVs have been exported, a 78% year-on-year enhance.

The expansion of “new vitality car” (NEV, primarily EVs) manufacturing and gross sales is proven within the determine beneath, which additionally exhibits their rising share of all autos bought.

China’s EV market is very aggressive, with at the very least 94 manufacturers providing greater than 300 fashions. Home manufacturers account for 81% of the EV market, with BYD, Wuling, Chery, Changan and GAC among the many high gamers.

Sustaining this development has required main funding in manufacturing capability.

This evaluation estimates investments in EV manufacturing capability based mostly on a examine by China Worldwide Affiliation for Promotion of Science and Know-how (CIAPST), which put funding in EV manufacturing at 0.7tn yuan in 2021.

The evaluation assumes that EVs accounted for all the development in funding in car manufacturing capability reported by China’s nationwide bureau of statistics (NBS) in 2022 and 2023, whereas funding in standard autos was secure

This means that funding in EV manufacturing reached CNY 1.2tn yuan in 2023. That is prone to be conservative, as a result of manufacturing volumes for combustion engine autos are falling, implying a corresponding fall in funding.

This evaluation accounts for the enlargement of battery manufacturing capability individually – alongside electrical energy storage – though it’s being pushed by the expansion in EV manufacturing.

The evaluation estimates the worth of EV manufacturing, together with each home gross sales and exports, based mostly on car manufacturing volumes from NBS and the reported common EV value.

These EV costs embrace the worth of batteries produced for EVs, so the worth of battery manufacturing will not be included individually.

In the meantime, EV charging infrastructure is increasing quickly, enabling the expansion of the EV market. In 2022, greater than 80% of the downtown areas of “first-tier” cities – megacities akin to Beijing, Shanghai and Guangzhou – had put in charging stations, whereas 65% of the freeway service zones nationwide offered charging factors.

Greater than 3m new charging factors have been put into service throughout 2023, together with 0.93m public and a pair of.45m personal chargers. The gathered complete by November 2023 reached 8.6m charging factors.

This evaluation places funding in EV charging infrastructure at 0.1tn yuan in 2023, based mostly on an estimated common price of 30,000 yuan per charging level.

Again to high

Vitality effectivity

China’s vitality depth discount targets have put stress on industries to cut back their vitality use per unit of output, spurring funding in additional environment friendly processes.

For this evaluation, the scale of the marketplace for vitality service firms is used as a proxy for funding in vitality effectivity in industries and buildings. This market grew to an estimated 0.6tn yuan in 2023, up from 0.5tn yuan in 2022, based mostly on the income development of the highest 10 listed vitality service firms ranked by market capitalization, for the primary two or three quarters of 2023.

Over the previous twenty years, China’s vitality service sector has skilled speedy enlargement, rising from 1.8bn yuan in 2003 to 607bn yuan in 2021. Funding within the industrial service sector has been a key driver, accounting for about 60% of the whole funding.

Nevertheless, 2022 noticed a big downturn within the industrial vitality service output, influenced by poor industrial development, though the constructing service sector continued increasing.

This evaluation places China’s funding in constructing vitality effectivity at 80bn yuan per 12 months. The nation’s 14th five-year plan for vitality financial savings in buildings and improvement of “inexperienced buildings” targets 80m sq. metres per 12 months of renovated and newly constructed inexperienced buildings.

In contrast with the virtually 1,000m sq. metres of constructing house accomplished yearly, this can be a small share, and accordingly, the estimated worth of complete investments is modest.

Again to high

Electrical energy storage and hydrogen

China is quickly scaling up electrical energy storage capability. This has the potential to considerably cut back China’s reliance on coal- and gas-fired energy vegetation to satisfy peaks in electrical energy demand and to facilitate the combination of bigger quantities of variable wind and solar energy into the grid.

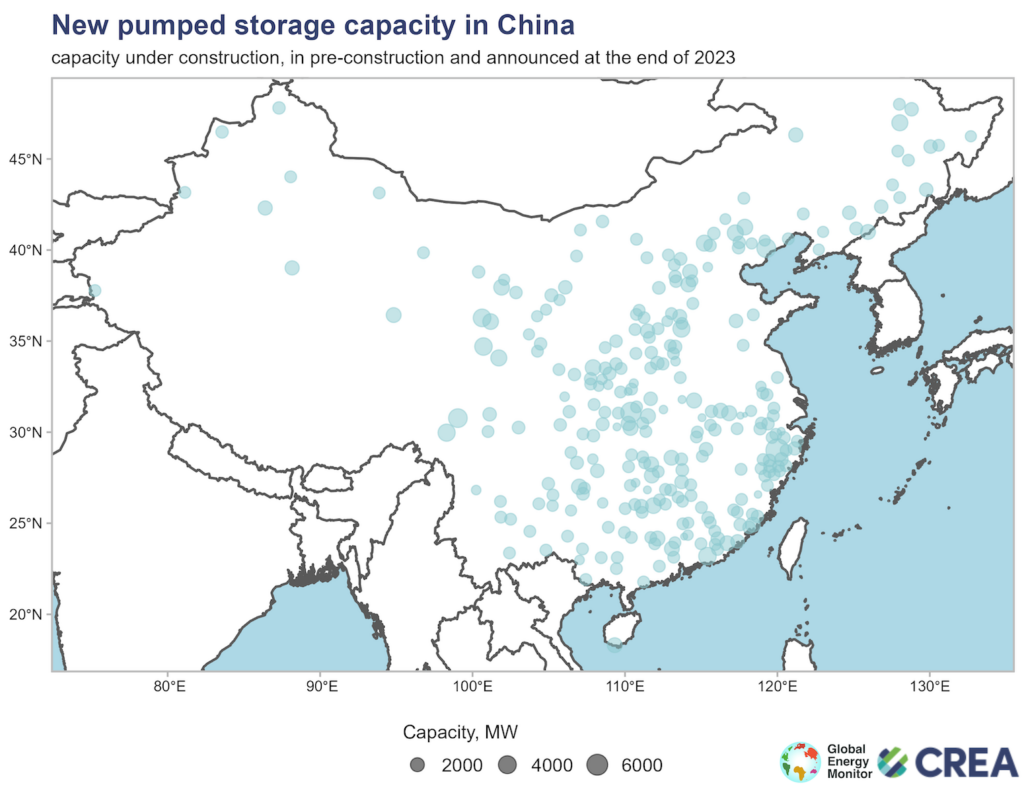

The development of pumped hydro storage capability elevated dramatically within the final 12 months, with capability below building reaching 167GW, up from 120GW a 12 months earlier.

This development is illustrated within the determine beneath, which exhibits pumped hydro capability below building or in earlier levels of improvement on the finish of 2023.

Information from International Vitality Monitor identifies one other 250GW in pre-construction levels, indicating that there’s potential for the present surge in capability to proceed.

For this evaluation, estimated annual investments in pumped storage are assumed to be proportional to the capability below building, whereas the reported building price of 6 yuan per watt is unfold over three years. This means that funding in 2023 amounted to 0.3tn yuan.

Building of recent battery manufacturing capability was one other main driver of investments, estimated at 0.3tn. That is based mostly on the added capability reported by the China Automotive Energy Battery Business Innovation Alliance and estimated common funding prices per unit of manufacturing capability, taken from a compilation of publicly reported undertaking prices.

Funding in electrolysers for “inexperienced” hydrogen manufacturing nearly doubled year-on-year in 2023, reaching roughly 90bn yuan, based mostly on estimates for the primary half of the 12 months from SWS Analysis. Analyst stories and compilations of tasks printed in information media put far bigger numbers on China’s investments in inexperienced hydrogen, however these typically embrace the spending on electrical energy era, which on this evaluation is accounted for individually.

Funding in “new vitality storage applied sciences” – a classification dominated by batteries – greater than doubled in 2023, reaching 75bn yuan. This estimate is predicated on newly added capability in 2023 reported by China Vitality Storage Alliance and common funding prices calculated from Nationwide Vitality Administration information.

Again to high

Railways

China’s ministry of transportation reported that funding in railway building elevated 7% in January–November 2023, implying funding of 0.8tn for the total 12 months. This consists of main investments in each passenger and freight transport. Funding in roads fell barely, whereas funding in railways total grew by 22%.

The share of freight volumes transported by rail in China has elevated from 7.8% in 2017 to 9.2% in 2021, due to the speedy improvement of the railway community.

In 2022, some 155,000km of rail strains have been in operation, of which 42,000km have been high-speed. That is up from 146,000km of which 38,000km have been high-speed in 2020.

The worth of passenger and freight transportation on China’s railways elevated by 39% year-on-year in 2023, reaching almost 1tn yuan.

Again to high

Nuclear energy

In 2023, 10 nuclear energy models have been authorised in China, exceeding the anticipated price of 6-8 models per 12 months set by the China Nuclear Vitality Affiliation in 2020 for the second 12 months in a row.

There are 77 nuclear energy models which are at the moment working or below building in China, the second-largest complete on this planet. The full yearly funding in 2023 was estimated for this evaluation at 87bn yuan, a rise of 45% year-on-year, based mostly on information for January–November from the Nationwide Vitality Administration.

The best numbers of nuclear tasks are positioned in coastal provinces with massive concentrations of heavy business, akin to Guangdong, Fujian and Zhejiang, as the event of inland nuclear energy tasks stays stalled.

These provinces get round 20% of their electrical energy from nuclear energy and proceed to develop the expertise as a part of their efforts to chop emissions from their energy sectors.

Again to high

Electrical energy grids

China’s power-sector improvement plans embrace a significant enhance in inter-provincial electrical energy transmission capability and quite a few long-distance transmission strains from west to east.

State Grid, the government-owned operator that runs the vast majority of the nation’s electrical energy transmission community, has a goal to lift inter-provincial energy transmission capability to 300GW by 2025 and 370GW by 2030, from 230GW in 2021. These plans play a significant position in enabling the event of unpolluted vitality bases in western China.

China Electrical energy Council reported investments in electrical energy transmission at 0.5tn yuan in 2023, up 8% on 12 months – simply forward of the extent focused by State Grid.

Again to high

Why clear vitality took off in 2023

The clean-energy funding growth in 2023 is the result of a significant pivot in China’s macroeconomic technique. As this evaluation exhibits, funding flowed from actual property into manufacturing – primarily within the clean-energy sector.

Whole funding within the manufacturing business elevated by 9% year-on-year in 2023, whereas funding within the energy and warmth sectors climbed 23%. These will increase have been solely attributable to development in funding in clear vitality, with funding in different areas falling. Subsequently, China’s pivot into manufacturing was, in actuality, a pivot to cleantech manufacturing.

The explanation for this pivot was the contraction within the real-estate sector, the place funding fell by 10% year-on-year in 2022 and one other 9% in 2023. Whereas this drop was according to the federal government’s purpose to handle monetary dangers and extra leverage within the sector, it left a significant gap in combination funding demand and within the income of China’s native governments.

Native governments have been below stress to draw funding, which means that they provided beneficiant subsidies and helped organize financing.

The central authorities, for its half, eased private-sector entry to monetary markets and financial institution loans throughout the Covid-19 pandemic, facilitating the expansion of the clean-energy sector.

Not like the state-owned corporations dominating conventional industries, the low-carbon sector, largely composed of personal firms, gained entry to beforehand constrained credit score.

The importance of this financial shift is mirrored not solely within the figures revealed by this evaluation but in addition within the language being utilized by Chinese language media.

The three largest of clean-energy sectors by worth, specifically photo voltaic, storage and EVs, are being known as the “new three”, in distinction to the “outdated three” – clothes, residence home equipment and furnishings.

This pivot was solely doable as a result of China’s clean-energy insurance policies and wider industrial coverage had constructed the inspiration and scaled up these sectors in order that they have been primed for speedy development.

The post-Covid credit score “push” for clear vitality development additionally coincided with a requirement “pull”, pushed by falling prices and the elevated competitiveness of low-carbon applied sciences towards fossil fuels attributable to technological developments.

Furthermore, the announcement in 2020 of the 2060 carbon neutrality goal had raised expectations and offered the political sign for the scale-up.

Again to high

What clean-energy development means for China – and the world

Clear expertise has been an essential a part of China’s vitality coverage, industrial technique and local weather change efforts for a very long time. Final 12 months marked the primary time that the sector additionally grew to become a key financial driver for the nation. This has essential implications.

China’s reliance on the clean-technology sectors to drive development and obtain key financial targets boosts their financial and political significance. It might additionally help an accelerated vitality transition.

The huge funding in clear expertise manufacturing capability and exports final 12 months signifies that China has a significant stake within the success of unpolluted vitality in the remainder of the world and in build up export markets.

For instance, China’s lead local weather negotiator Su Wei not too long ago highlighted that the aim of tripling renewable vitality capability globally, agreed within the COP28 UN local weather summit in December, is a significant profit to China’s new vitality business. This may seemingly additionally imply that China’s efforts to finance and develop clear vitality tasks abroad will intensify.

Globally, China’s unprecedented clean-energy manufacturing growth has pushed down costs, with the price of photo voltaic panels falling 42% year-on-year – a dramatic drop even in comparison with the historic common of round 17% per 12 months, whereas battery costs fell by a fair steeper 50%.

This, in flip, has inspired a lot sooner take-up of clean-energy applied sciences.

Projections of solar energy deployment, particularly, have been upended. The IEA’s newest World Vitality Outlook launched an extra world vitality situation simply to have a look at the implications, projecting that if world deployment of solar energy and grid-connected batteries follows the enlargement of producing capability, then world power-sector coal use and carbon dioxide emissions could possibly be a large 15% decrease than within the base case by 2030. Many of the extra deployment of photo voltaic within the IEA’s revised projections is in China.

Even with the elevated deployment, nonetheless, there’s a restrict to how a lot solar energy, batteries and different clear expertise will be absorbed, because the manufacturing enlargement has already saturated many of the world market.

Which means the enlargement will run into overcapacity, if maintained. Then again, with the intention to hold driving development in funding, clean-technology manufacturing would want to not solely take up as a lot capital because it did in 2023, however hold rising funding 12 months after 12 months.

The clean-technology funding growth has offered a brand new lease of life to China’s investment-led financial mannequin. There are new clean-energy applied sciences the place there’s scope for enlargement, akin to electrolysers.

Finally, nonetheless, solely new sectors must be discovered for funding – or China’s financial mannequin must be remodeled as soon as there’s nowhere left for funding to circulation.

The manufacturing growth additionally cements China’s dominant place in clean-energy provide chains. Different international locations due to this fact face a selection of whether or not they need to profit from the low-cost provide of photo voltaic panels, batteries, EVs and different clean-energy expertise from China.

The choice is diversifying their provide and paying the price of constructing new provide chains, within the type of subsidies and import tariffs required to allow home producers or producers in third international locations to compete towards Chinese language suppliers. Such efforts would additional enhance provide and push down world costs even additional.

Again to high

Sharelines from this story

[ad_2]

Source link