[ad_1]

{“web page”:0,”yr”:2023,”monthnum”:12,”day”:13,”title”:”historic-deal-at-cop28-to-transition-away-from-all-fossil-fuels”,”error”:””,”m”:””,”p”:0,”post_parent”:””,”subpost”:””,”subpost_id”:””,”attachment”:””,”attachment_id”:0,”pagename”:””,”page_id”:0,”second”:””,”minute”:””,”hour”:””,”w”:0,”category_name”:””,”tag”:””,”cat”:””,”tag_id”:””,”writer”:””,”author_name”:””,”feed”:””,”tb”:””,”paged”:0,”meta_key”:””,”meta_value”:””,”preview”:””,”s”:””,”sentence”:””,”title”:””,”fields”:””,”menu_order”:””,”embed”:””,”category__in”:[],”category__not_in”:[],”category__and”:[],”post__in”:[],”post__not_in”:[],”post_name__in”:[],”tag__in”:[],”tag__not_in”:[],”tag__and”:[],”tag_slug__in”:[],”tag_slug__and”:[],”post_parent__in”:[],”post_parent__not_in”:[],”author__in”:[],”author__not_in”:[],”search_columns”:[],”ignore_sticky_posts”:false,”suppress_filters”:false,”cache_results”:true,”update_post_term_cache”:true,”update_menu_item_cache”:false,”lazy_load_term_meta”:true,”update_post_meta_cache”:true,”post_type”:””,”posts_per_page”:”5″,”nopaging”:false,”comments_per_page”:”50″,”no_found_rows”:false,”order”:”DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Wenli Bill Hao”,”title”:”Senior Lead, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”}]

Historic Deal at COP28 to Transition away from All Fossil Fuels

Jason Ye

Director, Components and Thematics Indices

S&P Dow Jones Indices

Clear power has definitely been a distinguished matter in 2023, particularly amongst these on the entrance and middle of discussions on the United Nations Local weather Change Convention (COP28) in Dubai, which simply concluded. As we’re approaching the tip of 2023, we wished to assessment the outcomes of the S&P World Clear Vitality Index Sequence rebalance from October and share a few of the key developments from the second half of the yr within the clear power area.

October Rebalance

Launched in 2007, the S&P World Clear Vitality Index has been a benchmark to measure clear energy-related corporations’ efficiency over the previous 16 years. In April 2021, we additionally launched the S&P World Clear Vitality Choose Index, which is designed to measure the 30 largest corporations in international clear power companies which might be listed on developed market exchanges.

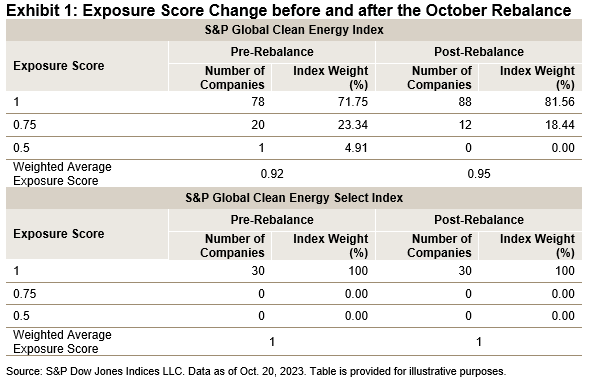

Each the S&P World Clear Vitality Index and the S&P World Clear Vitality Choose Index went via a semiannual rebalance on Oct. 20, 2023. Within the index methodology, we assign corporations to 4 buckets of publicity scores from 0 to 1 with an increment of 0.25 to measure their purity of publicity to the clear power enterprise. Exhibit 1 exhibits the change in publicity earlier than and after the October rebalance. We will see that for the S&P World Clear Vitality Index, put up rebalancing, we have now 10 extra corporations with an publicity rating of 1 being added to the index. The weighted common publicity rating of the index improved from 0.92 to 0.95. This exhibits the impact of rebalancing to enhance the purity of index publicity to scrub power corporations. The S&P World Clear Vitality Choose Index, alternatively, selects 30 corporations with an publicity rating of 1 listed within the developed market exchanges.

In the marketplace allocation breakdown, the main change of the S&P World Clear Vitality Index put up rebalancing is the three.11% weight improve in India and a pair of.72% weight improve in China, along with a 5.01% weight lower in Spain. For the S&P World Clear Vitality Choose Index, the load of the U.S. elevated by 11.86%, with a drop of 6.19% in New Zealand and a drop of 5.41% in Brazil.

S&P World Clear Vitality Index Efficiency YTD in 2023

After outperforming the S&P World BMI in 2022, each the S&P World Clear Vitality Index and the S&P World Clear Vitality Choose Index underperformed YTD via the tip of November 2023. The S&P World Clear Vitality Choose Index was down 21.49% and the S&P World Clear Vitality Index was down 27.88% in USD complete return phrases. There was vital dispersion seen amongst constituents; a few of the efficiency laggers included Sunpower Corp (-76.98%), SolarEdge Applied sciences (-71.98%) and Plug Energy (-67.34%), whereas Chubu Electrical Energy (up 38.24%), VERBUND AG (up 16.54%) and First Photo voltaic (up 5.33%) made up for a few of the loss with constructive efficiency contributions.

Regardless of the efficiency headwind, we proceed to see encouraging discussions all over the world on the power transition, together with the next chosen highlights.

Key Developments

The Worldwide Vitality Company (IEA) Launched the World Vitality Outlook 2023

In October, the IEA launched the World Vitality Outlook 2023, wherein it says that the usage of fossil fuels isn’t declining shortly sufficient, however the transfer to renewable power is “unstoppable”.1 In keeping with the report, “Tripling renewable power capability, doubling the tempo of power effectivity enhancements to 4% per yr, ramping up electrification and slashing methane emissions from fossil gasoline operations collectively present greater than 80% of the emissions reductions wanted by 2030 to place the power sector on a pathway to restrict warming to 1.5 °C.”2

World Pledge on Renewables and Vitality Effectivity

At COP28, the World Pledge on Renewables and Vitality Effectivity was signed by 121 international locations.3 Amongst different aims, those that signal the pledge decide to “work collectively to triple the world’s put in renewable power era capability to a minimum of 11,000 GW by 2030, bearing in mind totally different beginning factors and nationwide circumstances.”4

COP 28 Concluded with a Deal to Transition away from All Fossil Fuels

After many nights of debate, virtually 200 international locations reached a deal to transition away from all fossil fuels. This primary-ever settlement as soon as once more enforces the worldwide dedication to internet zero emissions by 2050. Though the deal isn’t legally binding, the message is loud and clear. It’s now on every nation to arrange its personal agenda so as to section out fossil fuels “in a simply, orderly and equitable method.”5

1 https://www.bbc.com/information/science-environment-67198206

2 IEA (2023), World Vitality Outlook 2023, IEA, Paris. https://www.iea.org/experiences/world-energy-outlook-2023

3 https://power.ec.europa.eu/information/cop28-eu-energy-days-focus-implementing-clean-energy-transition-after-launch-global-pledge-2023-12-04_en

4 https://power.ec.europa.eu/system/information/2023-12/Global_Renewables_and_Energy_Efficiency_Pledge.pdf

5 https://www.wsj.com/enterprise/energy-oil/cop28-leaders-call-for-transitioning-away-from-fossil-fuels-in-final-push-at-climate-talks-48f4b1c3

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Chasing Efficiency

Craig Lazzara

Managing Director, Index Funding Technique

S&P Dow Jones Indices

“…generally I’ve believed as many as six unimaginable issues earlier than breakfast.”– The White Queen, By the Wanting Glass

Ought to an asset proprietor depend on historic efficiency information to pick out managers? The efficacy of doing so relies on the solutions to a few questions:

What fraction of the supervisor universe is actually gifted?

How gifted are they?

How fortunate may the “bizarre” managers be?

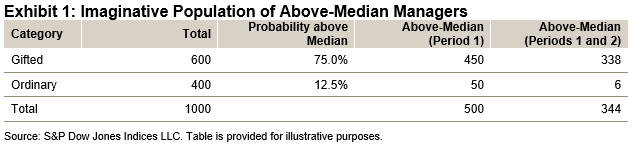

For instance: Suppose we assume that 60% of all managers are “gifted” and 40% are “bizarre,” {that a} gifted supervisor has a 75% likelihood of attaining above-median outcomes, and that an bizarre supervisor has a 12.5% likelihood of doing the identical. Exhibit 1 exhibits some implications of those assumptions for a 1000-manager universe.

Exhibit 1 accommodates each good and unhealthy information for our hypothetical asset proprietor. The excellent news is that after one interval, 90% (450/500) of the above-median managers are genuinely gifted; if our assumptions are appropriate, hiring solely from the above-median pool will carry the chances of success. The unhealthy information is that our assumptions are virtually definitely incorrect, to not say wildly unrealistic. Why? As a result of these assumptions indicate that 69% (344/500) of interval 1’s above-median managers may even be above median in interval 2—a persistence charge far larger than these we truly observe. Exhibit 1 is, sadly, an artifact of wishful pondering.

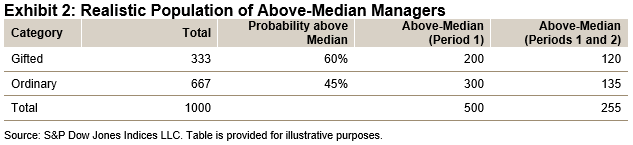

If Exhibit 1’s assumptions are clearly mistaken, what options is perhaps extra life like? To be extra modest, we will cut back the inhabitants of gifted managers from 60% to one-third, cut back their likelihood of rating above median from 75% to 60%, and slim the hole between the gifted and the bizarre by setting the bizarre managers’ likelihood of being above median at 45%. As earlier than, Exhibit 2 accommodates each good and unhealthy information for our hypothetical asset proprietor.

The excellent news is that utilizing Exhibit 2’s assumptions, 51% (255/500) of interval 1’s above-median managers ought to repeat that efficiency in interval 2. Though we don’t usually see outcomes that good, 51% persistence isn’t extraordinary, and so Exhibit 2 is a minimum of a considerably believable mannequin of actuality.

The unhealthy information in Exhibit 2 is that solely 40% (200/500) of interval 1’s above-median managers are genuinely gifted; 60% of them obtained there via luck moderately than ability. And maybe worse information: solely 47% (120/255) of the managers who’re above median in two consecutive intervals are genuinely gifted. In different phrases, an asset proprietor who hires from the above-median pool is extra prone to get an bizarre supervisor than a gifted one. Even when we assume that genuinely gifted managers exist—and that they keep gifted over time—hiring an above-median performer gives a less-than-even likelihood of discovering the gifted supervisor we’re searching for.

Lively administration is tough, as readers of our SPIVA Scorecards know nicely; figuring out excellent managers is maybe equally difficult. Counting on historic efficiency rankings is unlikely to be useful.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Get a Holistic Lens on Sustainability

Classes

ESG

Tags

Company Sustainability Evaluation, ESG, ESG information, ESG scores, affect investing, Indexing ESG, indexing sustainability, S&P World Company Sustainability Evaluation, S&P World CSA, S&P World ESG Scores, S&P World S1, S&P World Sustainability1, sustainability, sustainability information, sustainability indices

Make extra knowledgeable sustainability choices with deeper information – our indices are powered by analytics from the world-renowned S&P World Company Sustainability Evaluation.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Forging the World Vitality Transition: An Index for Important Metals

Classes

ESG, Thematics

Tags

cobalt, power transition expertise, ESG thematics, important metals, international power transition, lithium, Palladium, uncommon earths, S&P World Important Metals Producers Index, sustainability, Thematics ESG

Look contained in the S&P World Important Metals Producers Index, a pure-play index that tracks the businesses serving to the world forge the way forward for power innovation.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Surveying the Newest SPIVA India Scorecard Outcomes

Classes

Equities, Mounted Earnings

Tags

Lively vs. Passive, Benedek Voros, Bhavna Sadarangani, IIS, indexing, indexing India, India, Indian Composite Bond Funds, Indian ELSS Funds, Indian Authorities Bond Funds, institutional investor, S&P BSE 100, S&P BSE 200, s&p indices versus lively, SPIVA, SPIVA India Mid-12 months 2023

Have been lively and glued revenue fund managers capable of sustain with their benchmarks within the newest SPIVA India Scorecard? Dive into the newest outcomes with S&P DJI’s Bhavna Sadarangani and Benedek Vörös.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

[ad_2]

Source link