[ad_1]

{“web page”:0,”yr”:2024,”monthnum”:3,”day”:18,”title”:”measuring-the-global-water-opportunity-set”,”error”:””,”m”:””,”p”:0,”post_parent”:””,”subpost”:””,”subpost_id”:””,”attachment”:””,”attachment_id”:0,”pagename”:””,”page_id”:0,”second”:””,”minute”:””,”hour”:””,”w”:0,”category_name”:””,”tag”:””,”cat”:””,”tag_id”:””,”writer”:””,”author_name”:””,”feed”:””,”tb”:””,”paged”:0,”meta_key”:””,”meta_value”:””,”preview”:””,”s”:””,”sentence”:””,”title”:””,”fields”:””,”menu_order”:””,”embed”:””,”category__in”:[],”category__not_in”:[],”category__and”:[],”post__in”:[],”post__not_in”:[],”post_name__in”:[],”tag__in”:[],”tag__not_in”:[],”tag__and”:[],”tag_slug__in”:[],”tag_slug__and”:[],”post_parent__in”:[],”post_parent__not_in”:[],”author__in”:[],”author__not_in”:[],”search_columns”:[],”ignore_sticky_posts”:false,”suppress_filters”:false,”cache_results”:true,”update_post_term_cache”:true,”update_menu_item_cache”:false,”lazy_load_term_meta”:true,”update_post_meta_cache”:true,”post_type”:””,”posts_per_page”:”5″,”nopaging”:false,”comments_per_page”:”50″,”no_found_rows”:false,”order”:”DESC”}

[{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”U.S. Head of Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Wenli Bill Hao”,”title”:”Director, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”Michael Orzano”,”title”:”Head of Global Exchanges Product Management”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Eduardo Olazabal”,”title”:”Associate Director, Global Exchange Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Margaret Dorn”,”title”:”Senior Director, Head of ESG Indices, North America”,”image”:”/wp-content/authors/margaret.dorn-390.jpg”,”url”:”https://www.indexologyblog.com/author/margaret-dorn/”},{“display”:”Narottama Bowden”,”title”:”Director, Sustainability Indices Product Management”,”image”:”/wp-content/authors/narottama_bowden-331.jpg”,”url”:”https://www.indexologyblog.com/author/narottama_bowden/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

Measuring the International Water Alternative Set

Classes

ESG, Thematics

Tags

ESG, infrastructure, S&P International Water Index, sustainability standards, sustainable thematics, thematic ESG, utilities, wastewater administration, water, water administration, water therapy

Look contained in the S&P International Water Index and the way it tracks the businesses serving to the world meet demand for this very important useful resource.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Australian Mid Caps: A Candy Spot for Diversification and Historic Outperformance

Sean Freer

Director, International Fairness Indices

S&P Dow Jones Indices

The S&P/ASX MidCap 50 was up 5.35% in February, outperforming the S&P/ASX 50—which posted 0.25%—by greater than 5%. This was the most important relative outperformance of the mid-cap phase in comparison with giant caps in a single month since October 2008.

A better take a look at Australian mid caps, as measured by the S&P/ASX MidCap 50, reveals the phase affords much less focus on the constituent and sector degree in comparison with each large-cap and broad market indices.

The S&P/ASX MidCap 50 excludes the large 4 banks and enormous mining firms, that are well-known for his or her giant representations within the large-cap S&P/ASX 50 and the broader S&P/ASX 200.

The illustration of Financials inside the S&P/ASX 50 has grown to over one-third of the index’s weight, with 5 of the highest 10 firms within the index coming from this sector, whereas the Supplies sector accounts for almost 1 / 4 of the index’s weight. In the meantime, the Financials and Supplies sectors collectively make up over 50% of the S&P/ASX 200, whereas representing lower than one-third of the S&P/ASX MidCap 50.

With much less weight in Financials and Supplies, the S&P/ASX Midcap 50 affords extra illustration to the Industrials sector, in addition to firms that will profit from technological developments and disruptive improvements inside the Info Expertise and Communication Companies sectors.

The Mid-Caps Phase Has Turn out to be Extra Distinct over the Previous 12 Months

Market actions and constituent turnover at rebalance durations over the previous 12 months have resulted within the sector composition of S&P/ASX MidCap 50 turning into extra differentiated than the S&P/ASX 50 and S&P/ASX 200. For instance, the S&P/ASX MidCap 50 has added round 5% to each the Industrials and Info Expertise sectors and three% to Communication Companies. In the meantime, the index weight of firms inside the Supplies and Vitality sectors has decreased.

The S&P/ASX MidCap 50 can also be a lot much less concentrated than the large-cap and broad market indices. For the S&P/ASX 50 and S&P/ASX 200, the highest 10 firms characterize 60% and 48% of the index weight, respectively, with Financials accounting for half of the highest 10 weight in each indices. In distinction, the highest 10 firms within the S&P/ASX MidCap 50 comprise lower than 35% of index weight, with a extra various sector unfold.

Mid-Cap Fairness Danger Premium Has Been Rewarded Traditionally

Each bottom-up and top-down elements can drive inventory market efficiency. In financial environments led by macro elements equivalent to rising or falling charges or growth and bust commodity cycles, the mid-cap phase has traditionally demonstrated differentiated efficiency traits versus giant caps and the broader market.

The S&P/ASX MidCap 50 underperformed the S&P/ASX 50 by greater than 5% in 2023, which was a interval characterised by rising rates of interest, the place traders valued high quality and dividends supplied by extra established giant caps. Nevertheless, over a full financial cycle, as proven by the 5- and 10-year efficiency figures, the mid-cap phase has outperformed giant caps and the broad market (see Exhibit 4).

Massive Caps Had been Extra Correlated to Small Caps on a Three-Yr Foundation

Traditionally, correlations between segments have elevated throughout macro-driven markets, such because the 2008 International Monetary Disaster and the newer COVID-19 pandemic. Correlations are nonetheless elevated on a rolling three-year foundation, which incorporates the COVID-19 restoration rally. Nevertheless, we’re beginning to see extra deviation amongst returns getting into the 36-month window, leading to a latest discount of large- versus mid-cap correlations, and apparently, decrease than the large- versus small-cap correlation.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Balancing Protection with Progress (Half II): The S&P High quality Developed Ex-U.S. LargeMidCap

Wenli Invoice Hao

Director, Elements and Dividends Indices, Product Administration and Growth

S&P Dow Jones Indices

As investments in synthetic intelligence proceed to growth, main indices within the U.S., Europe and Japan have hit all-time highs. In our earlier weblog, we reviewed how the S&P U.S. High quality Indices outperformed their corresponding benchmarks over each the brief and the long run. Equally, a top quality premium additionally exists in developed ex-U.S. fairness markets. As proven in Exhibit 1, for the one-year interval from Jan. 31, 2023, to Jan. 31, 2024, the S&P High quality Developed Ex-U.S. LargeMidCap outperformed its benchmark by an honest margin. On this weblog, we examine the index’s design, efficiency, traits and attribution.

High quality Metrics and Index Design

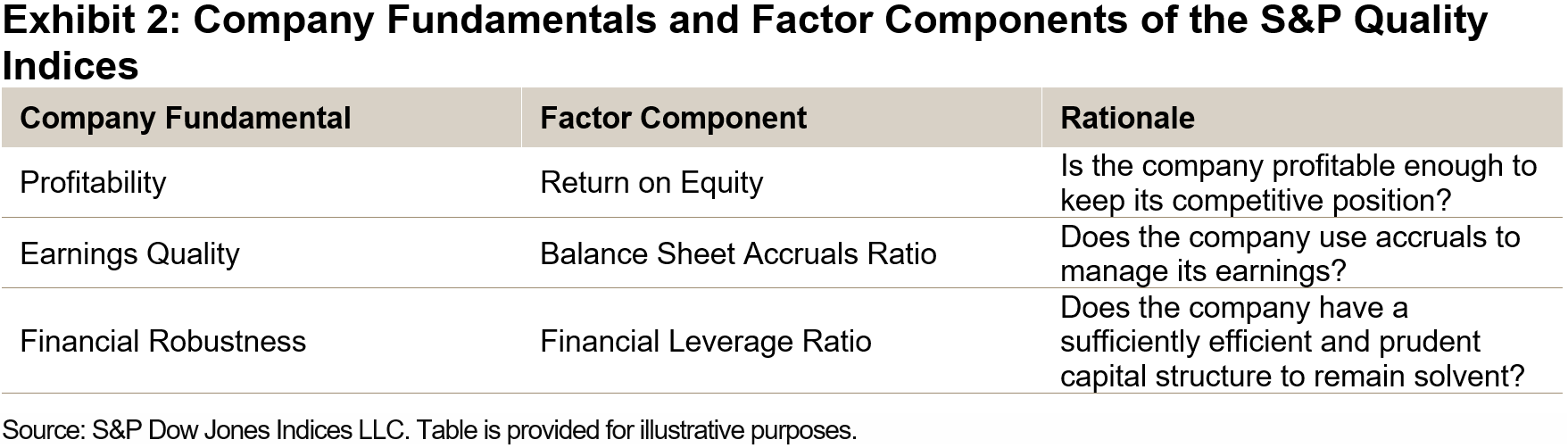

The S&P High quality Developed Ex-U.S. LargeMidCap makes use of the identical three outstanding metrics because the S&P U.S. High quality Indices. These metrics intention to seize an organization’s high quality traits: robust profitability, excessive earnings high quality and sturdy monetary power (see Exhibit 2). The index constituents correspond to the highest 20% of eligible shares inside the S&P Developed Ex-U.S. LargeMidCap’s universe, ranked by their general high quality scores. These constituents are weighted by the product of their market capitalization and high quality scores, topic to nation (most 40%), sector (most 40%) and particular person (most 5%) holding constraints.1

Efficiency Comparability

Traditionally, the S&P High quality Developed Ex-U.S. LargeMidCap has outperformed its benchmark over the brief and the long run with respect to complete return and risk-adjusted return (see Exhibit 3). Moreover, the standard technique has tended to exhibit defensive qualities, as evidenced by decrease beta and smaller drawdowns.

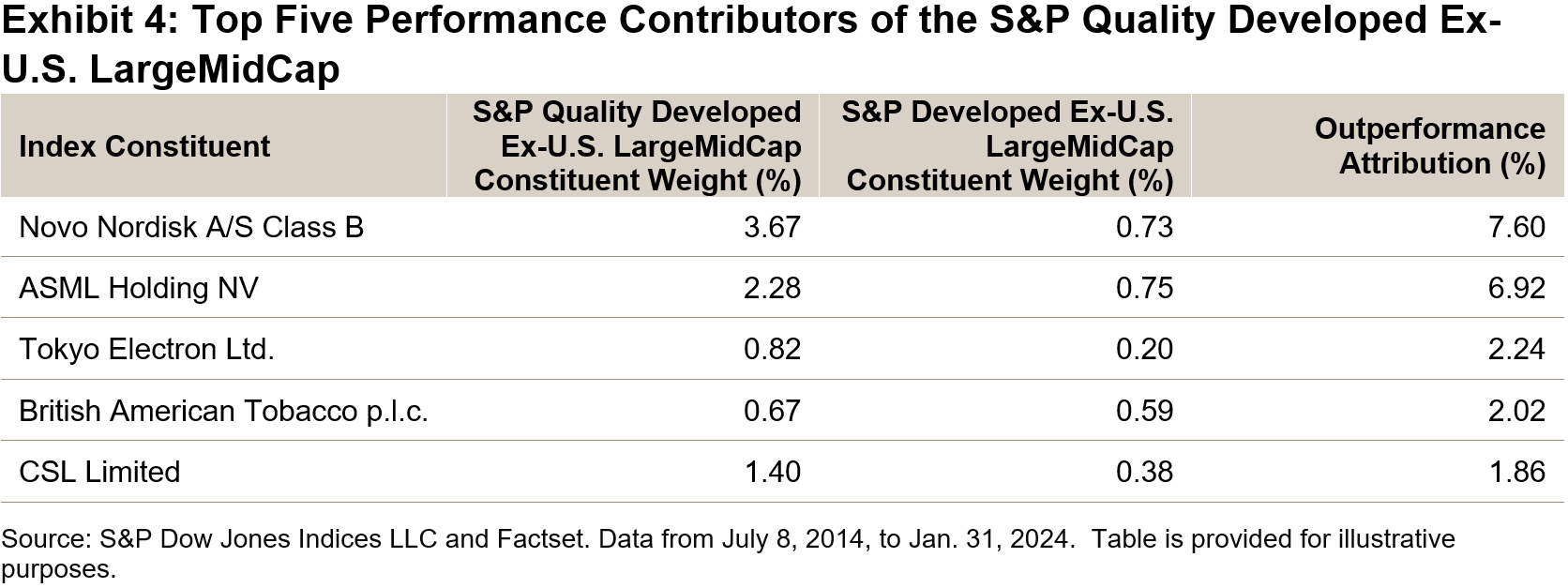

From its launch on July 8, 2014, to Jan. 31, 2024, the S&P High quality Developed Ex-U.S. LargeMidCap had a cumulative return of 71.19% (with an annualized volatility of 14.3%) versus a cumulative return of 51.87% (with an annualized volatility of 14.2%) for its benchmark. The outperformance of 19.32% was primarily from the highest 5 contributors that had been largely from the Info Expertise and Well being Care sectors (see Exhibit 4).

Excessive Upside Participation and Defensive Traits

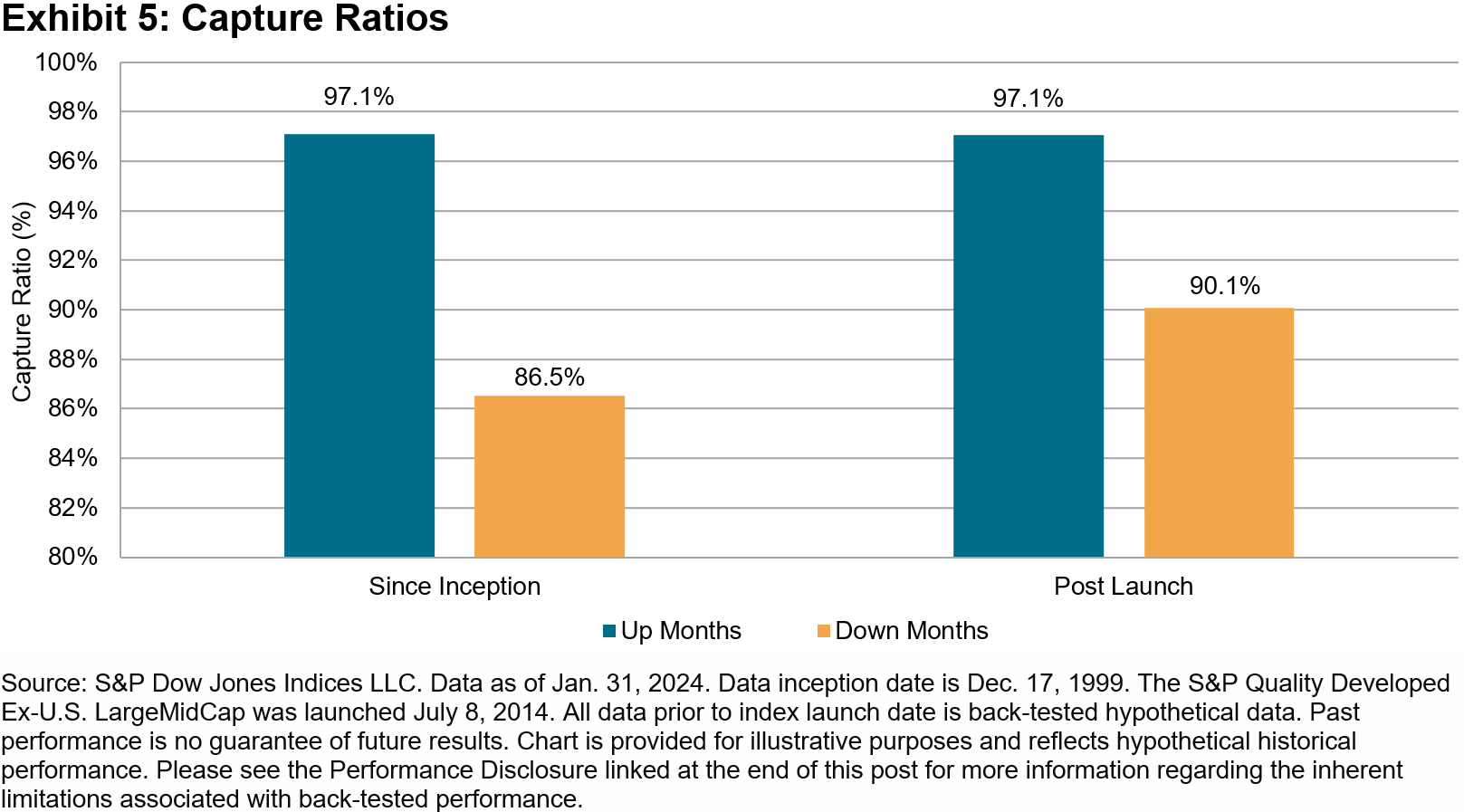

The historic seize ratios in Exhibit 5 present that the S&P High quality Developed Ex-U.S. LargeMidCap tended to take part one-for-one in up markets,2 whereas delivering important outperformance throughout down markets. Such options held true for the entire interval because the index inception date and post-launch interval. These distinctive traits make sense, since high quality indices are designed to trace firms with sturdy enterprise fashions and sustainable aggressive benefits.

Nation Publicity

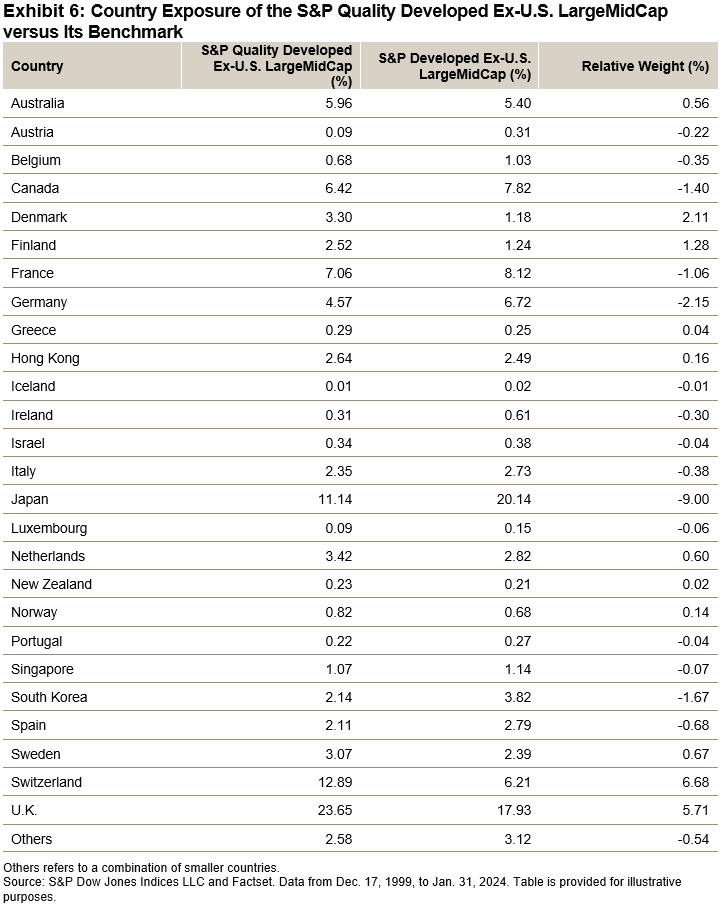

In Exhibit 6, we examine the nation allocation of the constituents within the S&P High quality Developed Ex-U.S. LargeMidCap and its benchmark. From Dec. 17, 1999, to Jan. 31, 2024, the index primarily overweighted Switzerland (6.68%) and the U.Ok. (5.71%) whereas underweighting Japan (-9.00%) and Germany (-2.15%).

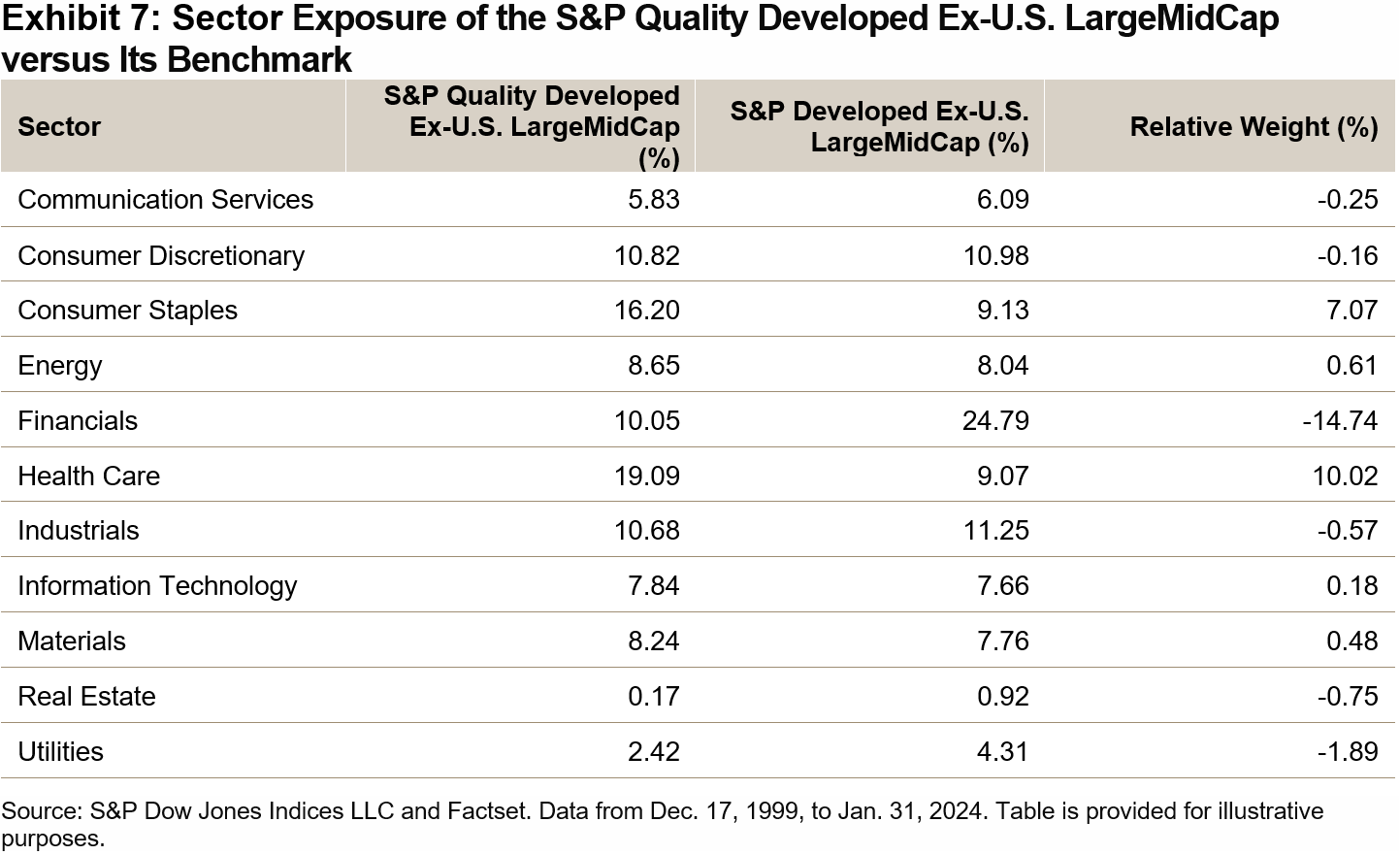

Sector Publicity

We subsequent discover the sector publicity of the S&P High quality Developed Ex-U.S. LargeMidCap. As seen in Exhibit 7, the index traditionally has had a major chubby in Well being Care (10.02%) relative to its benchmark, with a big underweight in Financials (-14.74%).

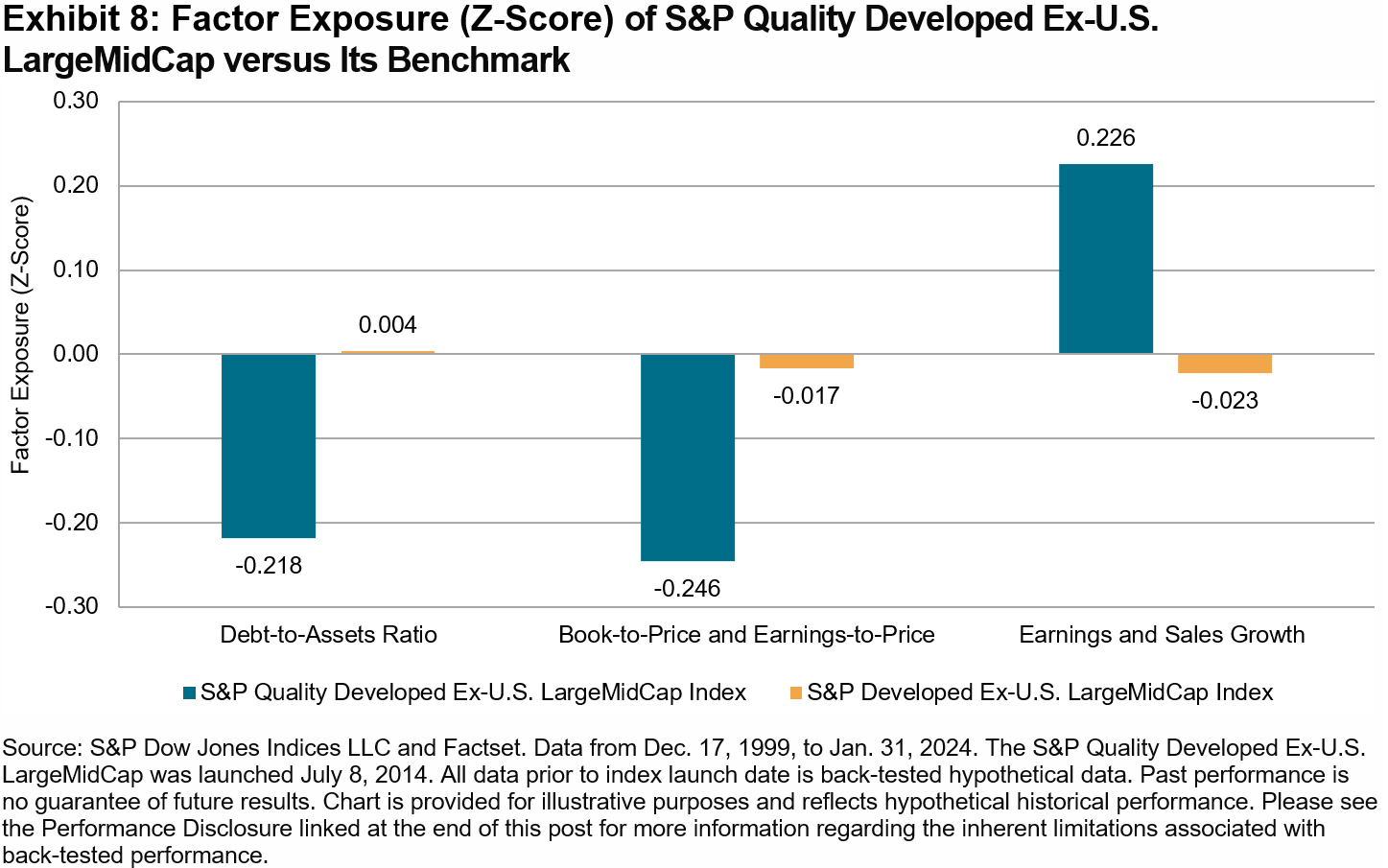

Issue Publicity

Exhibit 8 reveals the issue publicity of the S&P High quality Developed Ex-U.S. LargeMidCap versus its benchmark when it comes to the Axioma World-Huge Ex-US Danger Model3 Issue Z-scores. The standard index demonstrated robust high quality and progress tilts versus its benchmark. Particularly, the standard index had decrease exposures to leverage ratio and worth elements, with a better publicity to progress than its benchmark.

1 For additional details about the issue definition, issue rating calculation and index design, please see the S&P High quality Indices Methodology.

2 The market is outlined because the month-to-month efficiency of the underlying benchmark from Dec. 31, 1994, to July 31, 2023.

3 The Axioma World-Huge Ex-US Fairness Issue Danger Mannequin doesn’t have a mode issue for profitability.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

The February 2024 Rebalance of the S&P 500 Low Volatility Index

For the reason that earlier rebalance for the S&P 500® Low Volatility Index on Nov. 17, 2023, and its most up-to-date on Feb. 16, 2024, the S&P 500 delivered a surprising 11.3% return. Throughout this era, the S&P 500 Low Volatility Index was up 5.3%, robust by historic requirements, albeit underperforming the S&P 500. As has been the development lately, the S&P 500 Low Volatility Index traditionally tends to underperform during times of low volatility for the S&P 500. Over this era, the annualized day by day customary deviation for the S&P 500 was simply 10.1%.

As Exhibit 2 reveals, trailing one-year volatility decreased for all GICS sectors apart from Industrials as of Jan. 31, 2024, versus Oct. 31, 2023. The widespread decline in volatility continued the development that occurred all through most of 2023. Measured in absolute phrases, the sectors with the most important declines in volatility had been Client Discretionary, Communication Companies and Supplies, which dropped by 3.6%, 2.9% and a pair of.7%, respectively. Industrials was the one sector with a rise in volatility, rising from 15.9% to 19.0%.

Amid the general lower in volatility, the S&P 500 Low Volatility Index’s newest rebalance introduced adjustments to sector weightings, though the adjustments had been extra muted than latest rebalances. Client Staples misplaced 2.4%, probably the most of any sector, though it retained its place because the highest-weighted sector, at 23.4%. The most important recipients had been Info Expertise and Well being Care, receiving 1.8% and 1.4%, respectively. Supplies acquired a 1.0% allocation, leading to all 11 GICS sectors now being represented within the S&P 500 Low Volatility Index. The newest rebalance was efficient after the market shut on Feb. 16, 2024.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

U.S. Sector Relevance to China

Fei Wang

Senior Analyst, U.S. Fairness Indices

S&P Dow Jones Indices

Chinese language traders are inclined to exhibit excessive exposures to home equities. Incorporating U.S. equities may assist Chinese language traders diversify their methods and alleviate home-country bias. For instance, the S&P 500® could also be related for publicity and sensitivity to the U.S. financial system. Moreover, market contributors in search of to offset home fairness biases or categorical tactical views might want to contemplate the potential purposes of the S&P 500 sector indices.

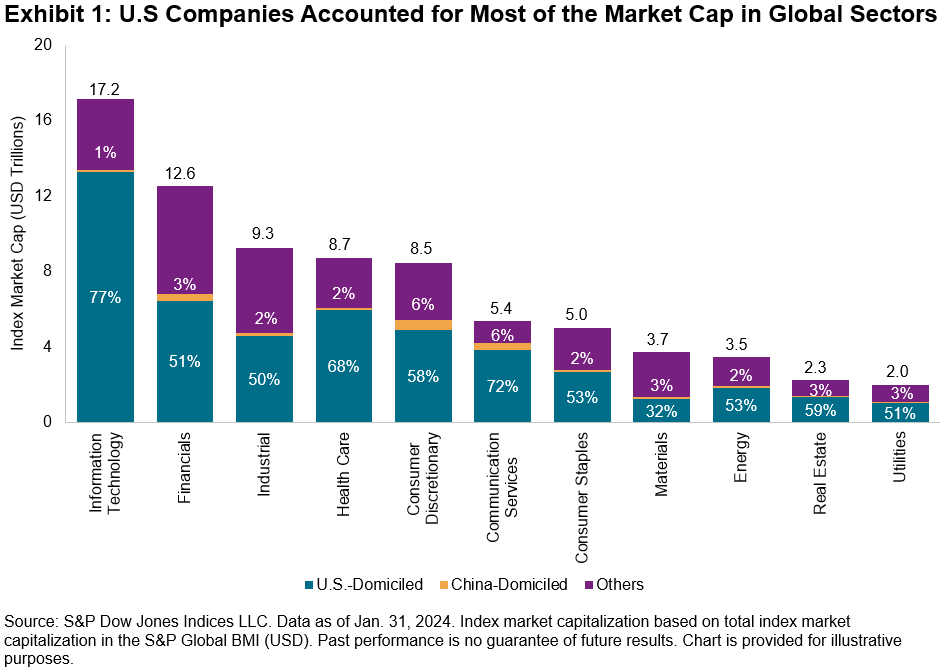

The illustration of U.S. equities in world fairness markets underscores the significance of a U.S. perspective when trying to categorical views on varied sectors. Exhibit 1 reveals the proportion of every GICS® sector represented by firms domiciled in several elements of the world. Particularly, U.S.-domiciled firms accounted for many of the market capitalization in 10 out of the 11 world sectors.

Furthermore, the breadth and depth of the U.S. equities market implies that the scale of S&P 500 sectors is similar to many international locations. As an illustration, as of Jan. 31, 2024, the market capitalization of the S&P 500 Info Expertise (USD 12 trillion) was second solely to the whole U.S. market within the S&P International BMI (USD 50 trillion). The S&P 500 Financials and S&P 500 Well being Care are comparable in measurement to the Japanese market. The dimensions of U.S. sector segments implies that expressing views by way of a sector lens may have introduced related alternatives—as measured by market measurement or capacity-adjusted dispersion—as expressing views by way of a rustic lens, traditionally.

The S&P Choose Sector 15/60 Capped Indices measure the efficiency of S&P 500 firms throughout the 11 GICS sectors, whereas using a capping mechanism that limits the burden of the most important firms within the index. These U.S. sector indices may assist Chinese language traders diversify their methods, particularly when the home market is underperforming.

Lately, China has grappled with a slower-than-expected restoration from the COVID-19 pandemic and encountered varied inner and exterior challenges. Throughout the identical interval, nonetheless, sure U.S. sectors showcased outstanding resilience and delivered substantial returns. For instance, the S&P Communication Companies Choose Sector 15/60 Capped Index, which skilled a bigger decline than the S&P China BMI in 2022 (-34% versus -22%, respectively), rebounded with a 42% return in 2023, whereas the S&P China BMI noticed an extra 10% drop.

Historic proof highlights the potential worth of using sectors to precise views on the U.S. Presidential election, as traders usually issue within the anticipated impression of candidates’ insurance policies on varied market segments. The 2016 election noticed a major divergence between the best- and worst-performing sectors, emphasizing the potential worth of expressing views by way of a sector lens. Extra lately, sector efficiency across the 2020 election was influenced by a number of dynamics, together with surging oil costs which helped Vitality firms to outperform (see Exhibit 4).

As we strategy the tip of 2024, a brand new spherical of the presidential election is underway. Given the prevailing world and U.S. situations, Chinese language traders may nonetheless leverage U.S. sectors to convey their views on the potential impacts of the election.

General, U.S. sectors characterize important market segments and will supply alternatives that Chinese language traders might not wish to overlook, whether or not for world equities publicity or tactical methods. The upcoming presidential election additional gives a platform for traders to precise views on U.S. issues, including an extra dimension to the strategic concerns for Chinese language traders.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

[ad_2]

Source link