[ad_1]

{“web page”:0,”12 months”:2024,”monthnum”:2,”day”:8,”identify”:”the-sp-500-esg-index-turns-5″,”error”:””,”m”:””,”p”:0,”post_parent”:””,”subpost”:””,”subpost_id”:””,”attachment”:””,”attachment_id”:0,”pagename”:””,”page_id”:0,”second”:””,”minute”:””,”hour”:””,”w”:0,”category_name”:””,”tag”:””,”cat”:””,”tag_id”:””,”writer”:””,”author_name”:””,”feed”:””,”tb”:””,”paged”:0,”meta_key”:””,”meta_value”:””,”preview”:””,”s”:””,”sentence”:””,”title”:””,”fields”:””,”menu_order”:””,”embed”:””,”category__in”:[],”category__not_in”:[],”category__and”:[],”post__in”:[],”post__not_in”:[],”post_name__in”:[],”tag__in”:[],”tag__not_in”:[],”tag__and”:[],”tag_slug__in”:[],”tag_slug__and”:[],”post_parent__in”:[],”post_parent__not_in”:[],”author__in”:[],”author__not_in”:[],”search_columns”:[],”ignore_sticky_posts”:false,”suppress_filters”:false,”cache_results”:true,”update_post_term_cache”:true,”update_menu_item_cache”:false,”lazy_load_term_meta”:true,”update_post_meta_cache”:true,”post_type”:””,”posts_per_page”:”5″,”nopaging”:false,”comments_per_page”:”50″,”no_found_rows”:false,”order”:”DESC”}

[{“display”:”Craig Lazzara”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/craig_lazzara-353.jpg”,”url”:”https://www.indexologyblog.com/author/craig_lazzara/”},{“display”:”Tim Edwards”,”title”:”Managing Director, Index Investment Strategy”,”image”:”/wp-content/authors/timothy_edwards-368.jpg”,”url”:”https://www.indexologyblog.com/author/timothy_edwards/”},{“display”:”Hamish Preston”,”title”:”Head of U.S. Equities”,”image”:”/wp-content/authors/hamish_preston-512.jpg”,”url”:”https://www.indexologyblog.com/author/hamish_preston/”},{“display”:”Anu Ganti”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/anu_ganti-505.jpg”,”url”:”https://www.indexologyblog.com/author/anu_ganti/”},{“display”:”Fiona Boal”,”title”:”Managing Director, Global Head of Equities”,”image”:”/wp-content/authors/fiona_boal-317.jpg”,”url”:”https://www.indexologyblog.com/author/fiona_boal/”},{“display”:”Phillip Brzenk”,”title”:”Managing Director, Global Head of Multi-Asset Indices”,”image”:”/wp-content/authors/phillip_brzenk-325.jpg”,”url”:”https://www.indexologyblog.com/author/phillip_brzenk/”},{“display”:”Wenli Bill Hao”,”title”:”Director, Factors and Dividends Indices, Product Management and Development”,”image”:”/wp-content/authors/bill_hao-351.jpg”,”url”:”https://www.indexologyblog.com/author/bill_hao/”},{“display”:”Howard Silverblatt”,”title”:”Senior Index Analyst, Product Management”,”image”:”/wp-content/authors/howard_silverblatt-197.jpg”,”url”:”https://www.indexologyblog.com/author/howard_silverblatt/”},{“display”:”John Welling”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/john_welling-246.jpg”,”url”:”https://www.indexologyblog.com/author/john_welling/”},{“display”:”Michael Orzano”,”title”:”Senior Director, Global Equity Indices”,”image”:”/wp-content/authors/Mike.Orzano-231.jpg”,”url”:”https://www.indexologyblog.com/author/mike-orzano/”},{“display”:”Maria Sanchez”,”title”:”Director, Sustainability Index Product Management, U.S. Equity Indices”,”image”:”/wp-content/authors/maria_sanchez-527.jpg”,”url”:”https://www.indexologyblog.com/author/maria_sanchez/”},{“display”:”Shaun Wurzbach”,”title”:”Managing Director, Head of Commercial Group (North America)”,”image”:”/wp-content/authors/shaun_wurzbach-200.jpg”,”url”:”https://www.indexologyblog.com/author/shaun_wurzbach/”},{“display”:”Silvia Kitchener”,”title”:”Director, Global Equity Indices, Latin America”,”image”:”/wp-content/authors/silvia_kitchener-522.jpg”,”url”:”https://www.indexologyblog.com/author/silvia_kitchener/”},{“display”:”Akash Jain”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/akash_jain-348.jpg”,”url”:”https://www.indexologyblog.com/author/akash_jain/”},{“display”:”Ved Malla”,”title”:”Associate Director, Client Coverage”,”image”:”/wp-content/authors/ved_malla-347.jpg”,”url”:”https://www.indexologyblog.com/author/ved_malla/”},{“display”:”Rupert Watts”,”title”:”Head of Factors and Dividends”,”image”:”/wp-content/authors/rupert_watts-366.jpg”,”url”:”https://www.indexologyblog.com/author/rupert_watts/”},{“display”:”Jason Giordano”,”title”:”Director, Fixed Income, Product Management”,”image”:”/wp-content/authors/jason_giordano-378.jpg”,”url”:”https://www.indexologyblog.com/author/jason_giordano/”},{“display”:”Brian Luke”,”title”:”Senior Director, Head of Commodities, Real & Digital Assets”,”image”:”/wp-content/authors/brian.luke-509.jpg”,”url”:”https://www.indexologyblog.com/author/brian-luke/”},{“display”:”Qing Li”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/qing_li-190.jpg”,”url”:”https://www.indexologyblog.com/author/qing_li/”},{“display”:”Sherifa Issifu”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/sherifa_issifu-518.jpg”,”url”:”https://www.indexologyblog.com/author/sherifa_issifu/”},{“display”:”George Valantasis”,”title”:”Associate Director, Factors and Dividends”,”image”:”/wp-content/authors/george-valantasis-453.jpg”,”url”:”https://www.indexologyblog.com/author/george-valantasis/”},{“display”:”Glenn Doody”,”title”:”Vice President, Product Management, Technology Innovation and Specialty Products”,”image”:”/wp-content/authors/glenn_doody-517.jpg”,”url”:”https://www.indexologyblog.com/author/glenn_doody/”},{“display”:”Priscilla Luk”,”title”:”Managing Director, Global Research & Design, APAC”,”image”:”/wp-content/authors/priscilla_luk-228.jpg”,”url”:”https://www.indexologyblog.com/author/priscilla_luk/”},{“display”:”Liyu Zeng”,”title”:”Director, Global Research & Design”,”image”:”/wp-content/authors/liyu_zeng-252.png”,”url”:”https://www.indexologyblog.com/author/liyu_zeng/”},{“display”:”Sean Freer”,”title”:”Director, Global Equity Indices”,”image”:”/wp-content/authors/sean_freer-490.jpg”,”url”:”https://www.indexologyblog.com/author/sean_freer/”},{“display”:”Barbara Velado”,”title”:”Senior Analyst, Research & Design, Sustainability Indices”,”image”:”/wp-content/authors/barbara_velado-413.jpg”,”url”:”https://www.indexologyblog.com/author/barbara_velado/”},{“display”:”Benedek Vu00f6ru00f6s”,”title”:”Director, Index Investment Strategy”,”image”:”/wp-content/authors/benedek_voros-440.jpg”,”url”:”https://www.indexologyblog.com/author/benedek_voros/”},{“display”:”Cristopher Anguiano”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/cristopher_anguiano-506.jpg”,”url”:”https://www.indexologyblog.com/author/cristopher_anguiano/”},{“display”:”Jason Ye”,”title”:”Director, Factors and Thematics Indices”,”image”:”/wp-content/authors/Jason%20Ye-448.jpg”,”url”:”https://www.indexologyblog.com/author/jason-ye/”},{“display”:”Michael Mell”,”title”:”Global Head of Custom Indices”,”image”:”/wp-content/authors/michael_mell-362.jpg”,”url”:”https://www.indexologyblog.com/author/michael_mell/”},{“display”:”Maya Beyhan”,”title”:”Senior Director, ESG Specialist, Index Investment Strategy”,”image”:”/wp-content/authors/maya.beyhan-480.jpg”,”url”:”https://www.indexologyblog.com/author/maya-beyhan/”},{“display”:”Andrew Innes”,”title”:”Head of Global Research & Design”,”image”:”/wp-content/authors/andrew_innes-189.jpg”,”url”:”https://www.indexologyblog.com/author/andrew_innes/”},{“display”:”Joseph Nelesen”,”title”:”Senior Director, Index Investment Strategy”,”image”:”/wp-content/authors/joseph_nelesen-452.jpg”,”url”:”https://www.indexologyblog.com/author/joseph_nelesen/”},{“display”:”Fei Wang”,”title”:”Senior Analyst, U.S. Equity Indices”,”image”:”/wp-content/authors/fei_wang-443.jpg”,”url”:”https://www.indexologyblog.com/author/fei_wang/”},{“display”:”Izzy Wang”,”title”:”Senior Analyst, Factors and Dividends”,”image”:”/wp-content/authors/izzy.wang-326.jpg”,”url”:”https://www.indexologyblog.com/author/izzy-wang/”},{“display”:”Rachel Du”,”title”:”Senior Analyst, Global Research & Design”,”image”:”/wp-content/authors/rachel_du-365.jpg”,”url”:”https://www.indexologyblog.com/author/rachel_du/”},{“display”:”Jaspreet Duhra”,”title”:”Managing Director, Global Head of Sustainability Indices”,”image”:”/wp-content/authors/jaspreet_duhra-504.jpg”,”url”:”https://www.indexologyblog.com/author/jaspreet_duhra/”},{“display”:”Srineel Jalagani”,”title”:”Senior Director, Thematic Indices”,”image”:”/wp-content/authors/srineel_jalagani-446.jpg”,”url”:”https://www.indexologyblog.com/author/srineel_jalagani/”},{“display”:”Eduardo Olazabal”,”title”:”Senior Analyst, Global Equity Indices”,”image”:”/wp-content/authors/eduardo_olazabal-451.jpg”,”url”:”https://www.indexologyblog.com/author/eduardo_olazabal/”},{“display”:”Ari Rajendra”,”title”:”Senior Director, Head of Thematic Indices”,”image”:”/wp-content/authors/Ari.Rajendra-524.jpg”,”url”:”https://www.indexologyblog.com/author/ari-rajendra/”},{“display”:”Daniel Perrone”,”title”:”Former Director and Head of Operations, ESG Indices”,”image”:”/wp-content/authors/daniel_perrone-387.jpg”,”url”:”https://www.indexologyblog.com/author/daniel_perrone/”},{“display”:”Louis Bellucci”,”title”:”Senior Director, Index Governance”,”image”:”/wp-content/authors/louis_bellucci-377.jpg”,”url”:”https://www.indexologyblog.com/author/louis_bellucci/”},{“display”:”Elizabeth Bebb”,”title”:”Director, Factor & Dividend Indices”,”image”:”/wp-content/authors/elizabeth_bebb-511.jpg”,”url”:”https://www.indexologyblog.com/author/elizabeth_bebb/”},{“display”:”Margaret Dorn”,”title”:”Senior Director, Head of ESG Indices, North America”,”image”:”/wp-content/authors/margaret.dorn-390.jpg”,”url”:”https://www.indexologyblog.com/author/margaret-dorn/”},{“display”:”Raghu Ramachandran”,”title”:”Head of Insurance Asset Channel”,”image”:”/wp-content/authors/raghu_ramachandram-288.jpg”,”url”:”https://www.indexologyblog.com/author/raghu_ramachandram/”}]

The S&P 500 ESG Index Turns 5!

Margaret Dorn

Senior Director, Head of ESG Indices, North America

S&P Dow Jones Indices

The S&P 500® ESG Index celebrated its fifth birthday on Jan. 28, 2024. Over the previous 5 years, the index has change into an essential piece of the sustainable indexing puzzle for traders seeking to leverage the energy of the S&P 500 whereas incorporating significant and measurable sustainability-focused enhancements.

Historically, five-year celebrations are marked by gifting one thing produced from wooden. As a logo, wooden represents energy, stability and the flexibility to face up to challenges. It embodies the vitality wanted to beat obstacles and adapt to altering circumstances. In some ways, that is applicable symbolism for an index that has been designed to assist traders tackle the challenges and altering circumstances in an evolving world.

Let’s have fun this milestone with a fast look again on the previous 5 years of the S&P 500 ESG Index.

From the Starting

The launch of the S&P 500 ESG Index on Jan. 28, 2019, signaled an evolution in sustainable investing. The index crammed an essential hole for traders searching for to include ESG values whereas sustaining related total traits to the broadly recognized and utilized S&P 500 (see Exhibit 1).

Evolving Sustainability Panorama

Adapting to the ever-changing panorama of sustainable indexing has been important over the lifespan of the S&P 500 ESG Index. A number of refinements have been made to the index methodology to replicate the evolving sentiments of a sustainability-minded investor. These views have been voiced within the outcomes of a number of market consultations that led to a revised and expanded checklist of exclusions based mostly on an organization’s involvement in sure enterprise actions (see Exhibit 2). The consultations additionally addressed a number of different related updates, together with extra frequent eligibility checks for enterprise involvement activities3 and UNGC exclusions.4 Most just lately, S&P Dow Jones Indices consulted the market on two key sustainability enhancements, which resulted within the change from the Sustainalytics Product Involvement to the S&P World Enterprise Involvement Screens and the change from the S&P DJI ESG Scores to the S&P World ESG Scores.5

With these enhancements, the S&P 500 ESG Index has retained its major goal, which is to keep up related total trade group weights to the S&P 500, whereas enhancing the general sustainability profile of the index with a median ESG Rating enchancment of seven.65% over its five-year lifespan.7

5-Yr Efficiency

As seen in Exhibit 3, the S&P 500 ESG Index has outperformed the S&P 500 not solely over its 5 years of reside historical past, however over the shorter-term one-year and three-year durations as effectively. One may assume that this outperformance has come on the expense of an elevated danger profile for the index, however as we will see in Exhibit 4 that’s not the case. The chance/efficiency profile of the S&P 500 ESG index was considerably higher than the S&P 500 over each the three- and five-year timeframes.

Efficiency Perspective

One of many major criticisms round sustainability funding methods is that the over (or below) efficiency is solely a results of over (or below) weights to explicit sectors. In Exhibit 5, it’s clear that it isn’t true for the S&P 500 ESG Index, which has maintained related sector publicity to the S&P 500 since its launch. That is additional evidenced by inspecting the efficiency attribution of the S&P 500 ESG Index. Exhibit 6 highlights that the surplus returns have been primarily pushed by inventory choice quite than variations in sector publicity. That is by design, because the methodology lends itself to a broadly sector-neutral end result. Thus, the outperformance was not all essentially because of vital overexposure to Data Expertise and underexposure to Power, as some may assume.

Conclusion

The 5 years of reside historical past for the S&P 500 ESG Index is certainly one thing to have fun, and we stay up for watching our sustainable indexing star proceed to shine.

1 Illustration displays the present use of the S&P DJI ESG Scores within the index methodology. On Jan. 23, 2024, S&P Dow Jones Indices introduced the outcomes of a session which disclosed the transitioning of the S&P DJI ESG Scores to the S&P World ESG Scores. The adjustments might be carried out as of the market open on Could 1, 2024. For extra data on the S&P World ESG Scores, please confer with the S&P World ESG Scores Methodology.

2 In circumstances the place dangers are offered, S&P World releases a Media and Stakeholder Evaluation (MSA) which features a vary of points comparable to financial crime and corruption, fraud, unlawful industrial practices, human rights points, labor disputes, office security, catastrophic accidents and environmental disasters. The Index Committee critiques constituents flagged by S&P World’s MSA to judge the potential affect of controversial firm actions on the composition of the indices. If the Index Committee decides to take away an organization, that firm is ineligible for re-entry for not less than one full calendar 12 months, starting with the following rebalancing.

3 Index constituents are reviewed on a quarterly foundation for ongoing eligibility below the Enterprise Actions exclusion standards. Firms decided to be ineligible are faraway from the index, efficient after the shut of the final enterprise day of July, October and January. The reference date for this evaluate is the final enterprise day of the earlier month. No constituent might be added to the index on account of any deletion which will happen. Modifications to Sustainalytics protection aren’t thought of as a part of this evaluate.

4 Because of market session that was finalized Jan. 23, 2024, S&P DJI is revising the Quarterly Eligibility Evaluate course of in related indices, so UNGC eligibility is at all times reviewed in March, June, September and December, in step with the schedule of the World Requirements Screening dataset. This can guarantee a well timed removing of these corporations labeled as Non-Compliant with UNGC eligibility necessities whatever the rebalancing schedule of the precise index. For extra data on the outcomes of this session, please go to UNGC Quarterly Eligibility Evaluate Methodology Updates

5 Each enhancements might be carried out to align with the annual rebalance of the S&P 500 ESG index which is efficient after the shut of the final enterprise day of April. For extra data, please reference Transitioning S&P Sustainability Indices to S&P World ESG Scores and Enterprise Involvement Screens (spglobal.com)

6 For extra data available on the market consultations that resulted in these adjustments, please go to Historic Bulletins – Shopper Useful resource Heart | S&P Dow Jones Indices (spglobal.com)

7 The index has achieved a median S&P DJI ESG Rating enchancment of seven.65% (on the index stage) from Jan. 27, 2020-Jan. 29, 2024, representing a median of 21.47% of the general ESG enchancment potential, given the sustainability traits of the beginning universe.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Bond Beginnings and Past

Anu Ganti

Senior Director, Index Funding Technique

S&P Dow Jones Indices

American political advisor James Carville as soon as commented that he’d prefer to be resurrected because the bond market as a result of, “you may intimidate everybody.” As of July 2023, the worldwide bond market contains about USD 135 trillion of securities, of which rated company debt represents USD 23 trillion.1 U.S. company debt makes up roughly half of the worldwide whole, and as Exhibit 1 illustrates, the Eighties had been a turning level within the U.S., as corporations more and more switched away from searching for financial institution loans for financing wants and towards leveraging the rising debt capital markets.

The composition of bond holders has additionally advanced. Most evidently, direct retail possession of corporates and U.S. Treasuries has close to halved, from 20% of excellent issuance in 2010 to 11% as of Q2 2023. In the meantime, property in U.S. bond mutual funds have nearly doubled. This has been a part of a broader pattern of “professionalization” or disintermediation, which noticed households gravitate away from direct safety possession and towards mutual funds in the course of the bull market of the Nineteen Nineties.

In distinction to the fairness markets, the place index-based funds have come to characterize nearly half of invested capital, about three-quarters of bond fund property had been nonetheless actively managed at year-end 2023, as we observe in Exhibit 3. That is partly as a result of mounted earnings index funds have a shorter historical past than their fairness cousins: a bond index fund didn’t exist till 1986, and the primary bond ETF wasn’t launched till 2002—each lagging their fairness equivalents by a decade or so.

Nonetheless, passive investing within the bond markets may catch up. Simply as in equities, it seems troublesome for lively managers to outperform over the long run. In the meantime, since 2010, the proportion of world mutual fund and ETF property which might be passively managed has actually grown quicker in bonds than in equities.

If the transformative trajectory of passive investing in fairness markets is any information for mounted earnings, the stage could now be set for a outstanding future for passive mounted earnings administration. To evaluate whether or not (and why) bond markets may proceed to catch up, we invite you to dive into our in-depth evaluation right here.

1 Refers back to the quantity of world and U.S. company debt rated by S&P World Scores as of July 2023. For extra data, please see Limbach, Sarah, Gunter, Evan M., and Singh, Vaishali, “Credit score Traits: World State of Play: Debt Progress Diverging By Credit score High quality,” Sept. 6, 2023.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

S&P Excessive Yield Dividend Aristocrats Rebalance: Let’s Welcome the 18 Latest Members

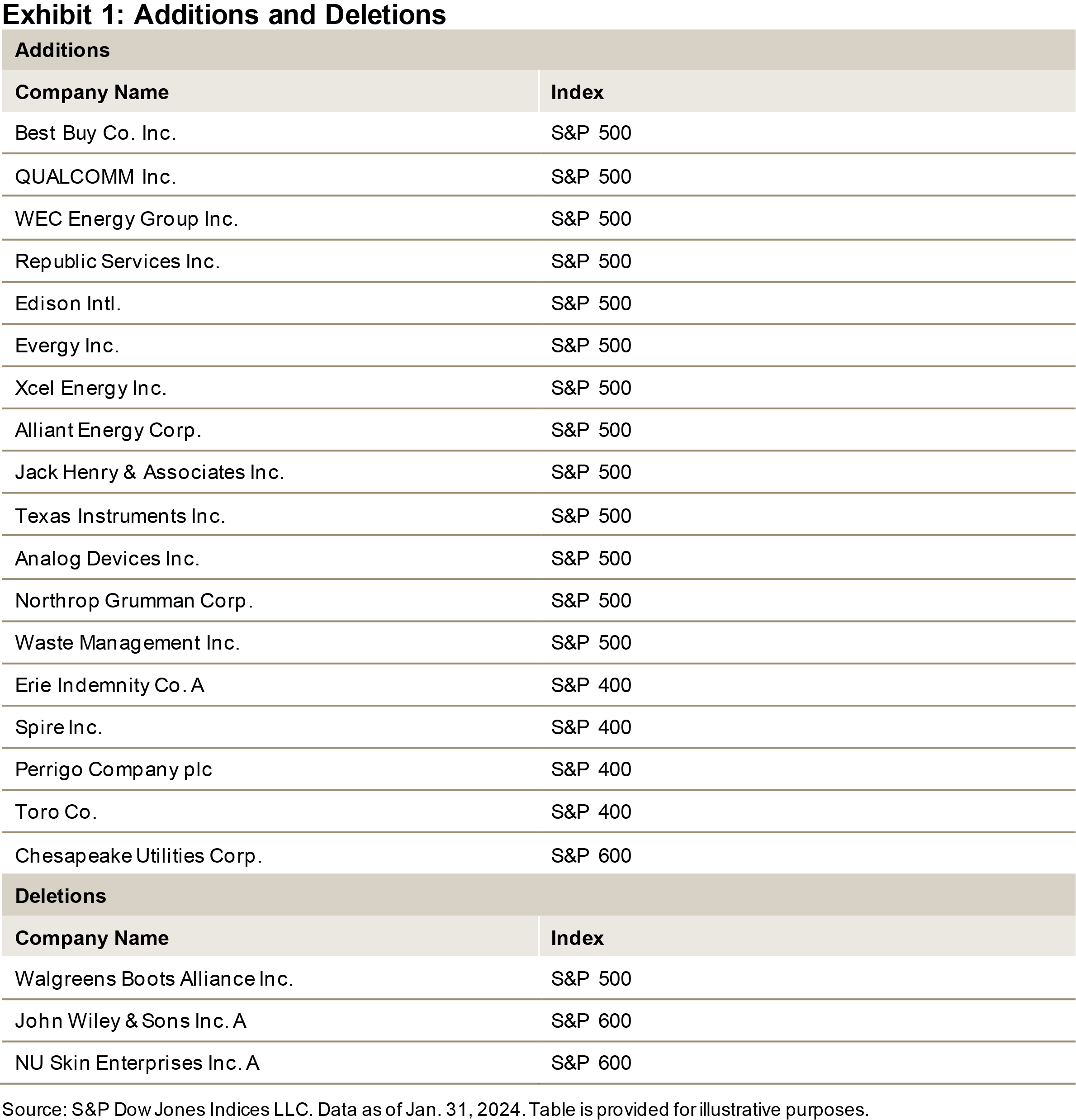

The S&P Excessive Yield Dividend Aristocrats® contains large-, mid-, and small-cap corporations within the U.S. which have raised their dividends for not less than 20 consecutive years. The index just lately concluded its annual reconstitution on Jan. 31, 2024, which introduced 18 new members into this completed group. Accounting for the three deletions, the index’s whole depend elevated from 121 to 136, which boosts its total diversification and liquidity. This weblog will look at the additions and deletions by means of a measurement and sector lens and supply a have a look at the laudable monitor file of constituents’ dividend will increase.

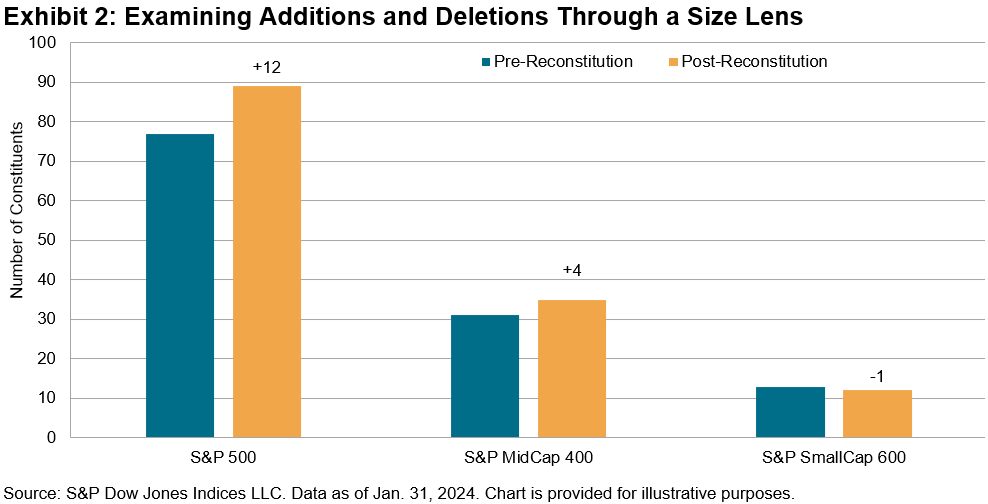

Exhibit 2 particulars how the reconstitution affected the S&P Excessive Yield Dividend Aristocrats from a measurement perspective. Pre-reconstitution, the index had 77, 31 and 13 constituents within the S&P 500®, S&P MidCap 400® and S&P SmallCap 600®, respectively. The 15 web additions included 12 web additions from the S&P 500, 4 additions from the S&P MidCap 400, and 1 web deduction from the S&P SmallCap 600. Submit-reconstitution, there are 89, 35 and 12 constituents from the S&P 500, S&P MidCap400 and S&P SmallCap 600, respectively.

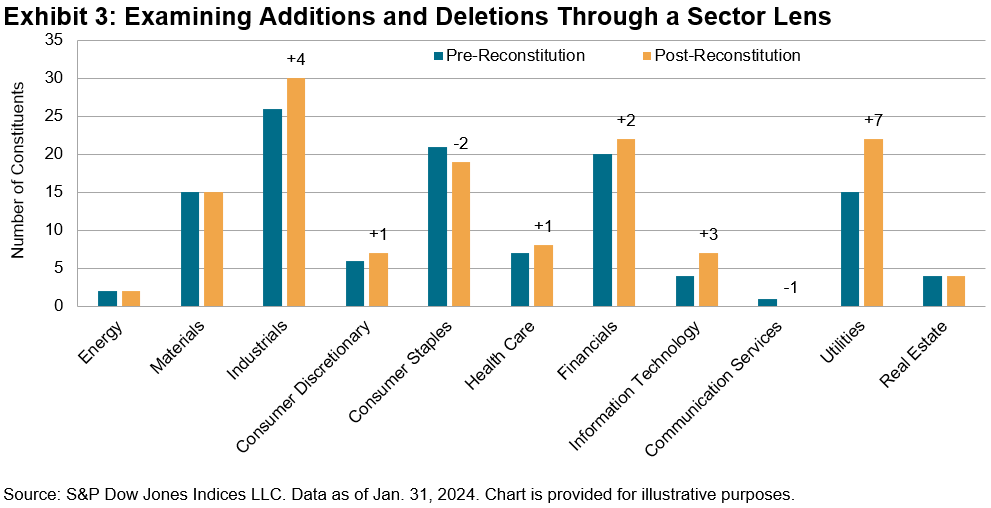

As Exhibit 3 shows, Utilities and Industrials had been the most important beneficiaries of the reconstitution, with their web counts rising by 7 and 4, respectively. Industrials now contains 30 constituents, 8 greater than the next-highest sectors by depend: Financials and Utilities, every with 22. After shedding two constituents, Client Staples dropped to the third-highest sector by depend, with 19. The lone constituent within the Communication Providers sector, John Wiley & Sons, was faraway from the index, leading to Communication Providers being the one GICS® sector with out illustration within the index.

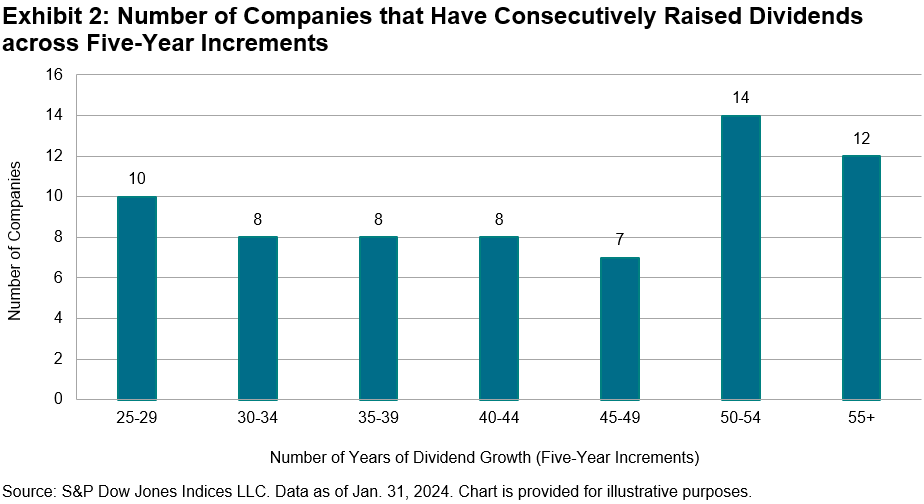

A Lengthy Historical past of Dividend Progress

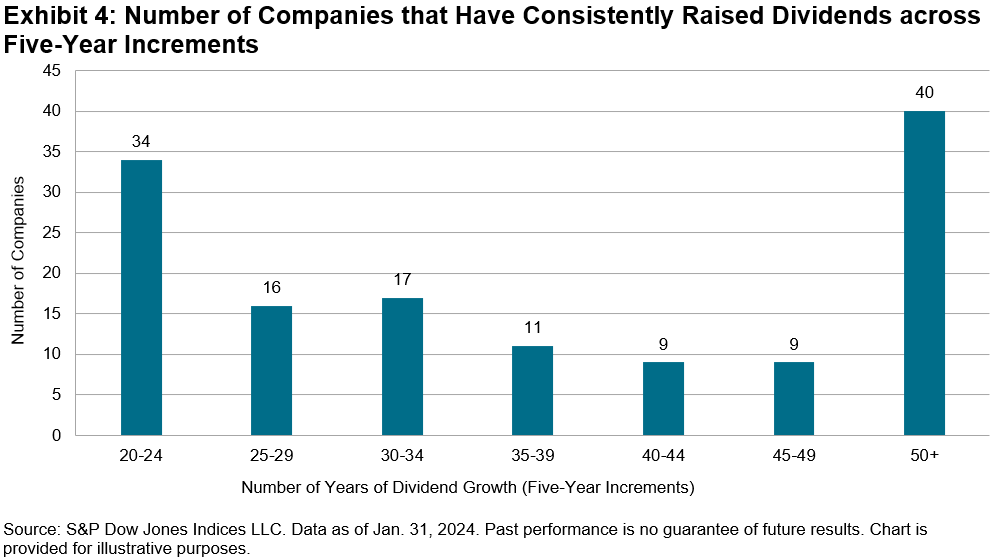

Exhibit 4 summarizes the variety of constituents which have elevated their dividends in five-year increments. Notably, over one-half of constituents have elevated their dividends for 35 years or longer, and over 36% have achieved this feat for 45 years or longer. These monitor information are actually commendable and display these corporations’ traditionally constant skill and willingness to return rising quantities of shareholder capital throughout a number of a long time.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

S&P 500 Dividend Aristocrats Rebalance: Fastenal in, Walgreens out

Wenli Invoice Hao

Director, Elements and Dividends Indices, Product Administration and Growth

S&P Dow Jones Indices

The S&P 500® Dividend Aristocrats® seeks to trace an elite group of corporations which have raised their dividends for at least 25 consecutive years. This index has simply concluded its annual reconstitution, which was efficient on the market shut on Jan. 31, 2024. Fastenal has been added, whereas Walgreens is out, which retains the membership checklist at 67 shares.

Introducing the Index’s Latest Member: Fastenal Firm

Fastenal is the newest firm to be added to this prestigious index by elevating its dividends for 25 consecutive years. This new S&P 500 Dividend Aristocrat is an industrial distributor that sells gadgets starting from fasteners to instruments and has advanced right into a provide chain answer firm.

As of Dec. 31, 2023, Fastenal has a gross margin of 45.7%,1 a return-on-equity of 34.5% and a low debt-to-equity ratio of seven.8%. Fastenal has a dividend yield of two.3%, which is in step with the two.4% total yield of the S&P 500 Dividend Aristocrats.

A Lengthy-Time period Member Is out: Walgreens Boots Alliance, Inc.

Walgreens Boots Alliance was dropped from the index after the pharmacy chain decreased its quarterly dividends by 48% to 25 cents per share. The transfer comes as the corporate seeks to strengthen its long-term steadiness sheet and money place.

Walgreens had been a long-time member of the S&P 500 Dividend Aristocrats, having elevated its annual dividends for nearly 50 years. Nonetheless, this index’s stringent methodology requires the 25 years to be consecutive, and guidelines are guidelines.

The S&P 500 Dividend Aristocrats Sector Breakdown

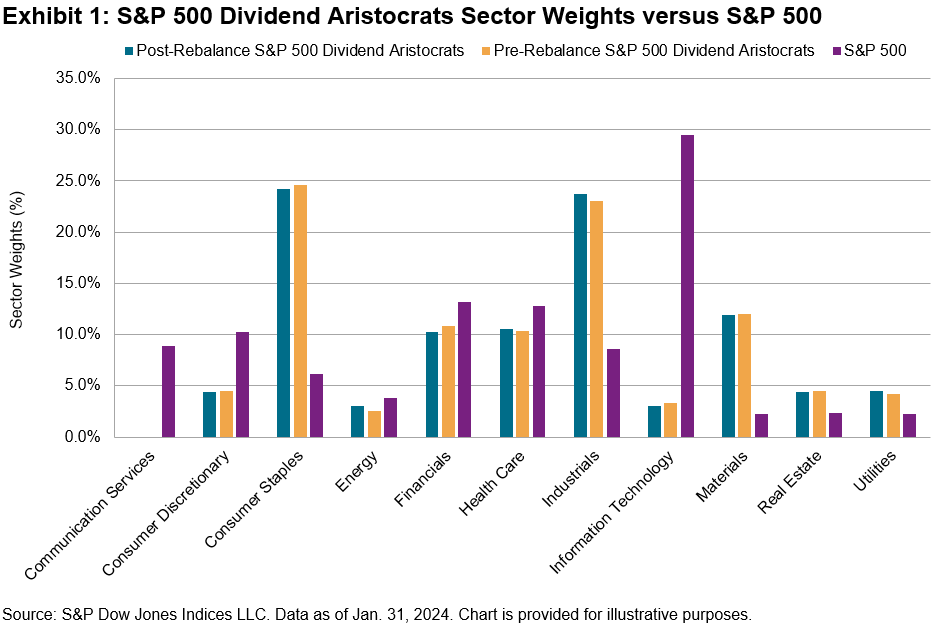

These adjustments didn’t have a cloth affect on the general sector weights. As Exhibit 1 reveals, the index retains its comparatively massive overweights in constant dividend-paying sectors comparable to Client Staples and Industrials, with massive underweights in IT, Communication Providers and Client Discretionary.

A Lengthy Historical past of Dividend Progress

Whereas one of many longer-standing members of the index was eliminated, Exhibit 2 reveals that greater than half of the present constituents within the S&P 500 Dividend Aristocrats have grown their dividends for greater than 40 years.

1 Taylor Ranta Oborski, Fastenal Firm Experiences 2023 Annual and Fourth Quarter Earnings, Jan. 18, 2024 .

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

The S&P Dividend Aristocrats Stay Benchmark Beaters in Pan Asia

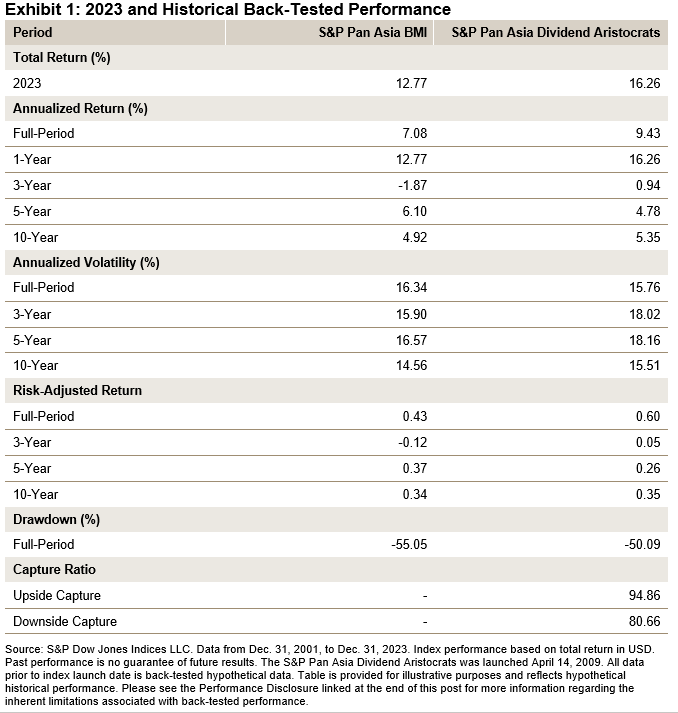

Whereas most dividend methods underperformed their respective benchmarks in 2023, the S&P Pan Asia Dividend Aristocrats® impressively outperformed the S&P Pan Asia BMI by roughly 3.50% (see Exhibit 1). Moreover, regardless of the outperformance, the S&P Pan Asia Dividend Aristocrats’ valuations and dividend yield remained favorable relative to the benchmark (see Reveals 3 and 4). This weblog will look at these metrics in additional element, along with offering an in depth efficiency attribution for 2023.

As Exhibit 1 reveals, the S&P Pan Asia Dividend Aristocrats’ sturdy 2023 efficiency additional boosted its long-term outperformance versus the S&P Pan Asia BMI. Going again to Dec. 31, 2001, the S&P Pan Asia Dividend Aristocrats has outperformed the S&P Pan Asia BMI on common by 2.35% yearly. Moreover, this long-term outperformance has been achieved whereas additionally delivering a decrease full-period volatility, most drawdown and draw back seize ratio.

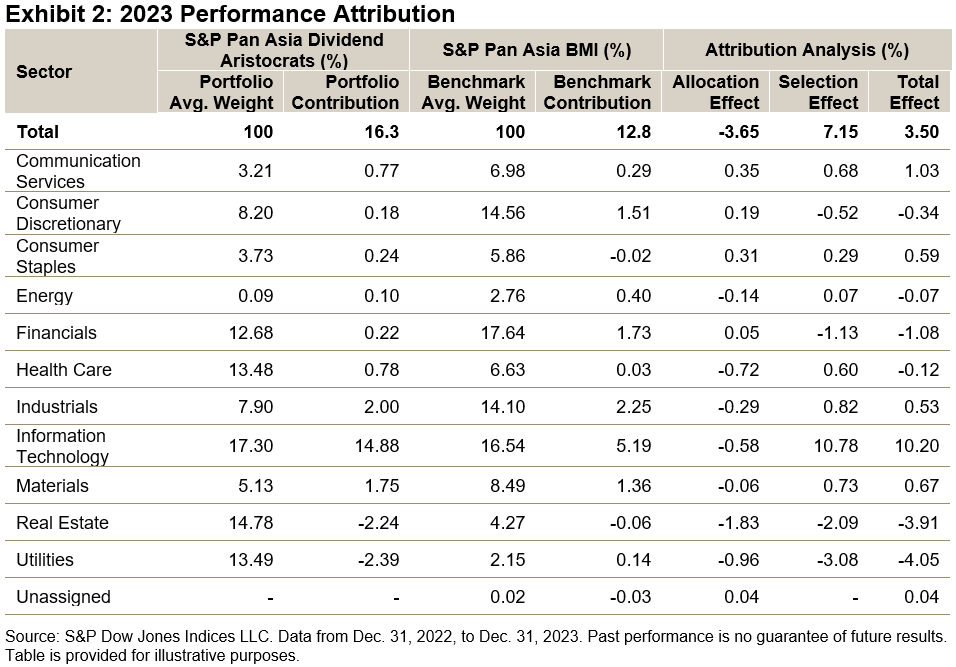

Exhibit 2 shows the 2023 efficiency attribution for the S&P Pan Asia Dividend Aristocrats and S&P Pan Asia BMI. As proven within the attribution evaluation columns, the entire outperformance totaled 3.50%, with 7.15% because of the bottom-up inventory choice impact and -3.65% from the allocation or sector impact. Data Expertise was the most important positive-contributing sector for the S&P Pan Asia Dividend Aristocrats, at 10.20%, with 10.78% from the choice impact and -0.58% because of the allocation impact.

The important thing differentiator of the S&P Pan Asia Dividend Aristocrats versus its benchmark is the requirement that shares should enhance dividends per share for not less than seven consecutive years. This filter, along with the payout and dividend yield filter, could bias the index towards choosing increased high quality shares because the skill to constantly develop dividends over the long run might be a sign of monetary energy and self-discipline.

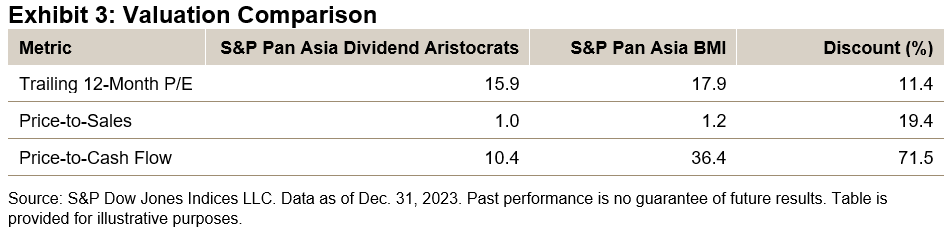

Exhibit 3 shows the valuation comparability and low cost of the S&P Pan Asia Dividend Aristocrats versus its benchmark. The index is cheaper on all three metrics proven, with a median low cost over the three metrics at roughly 34%. Not proven within the desk however essential nonetheless, is the return-on-equity (ROE) metric, which measures how effectively an organization makes use of shareholder capital to generate web earnings. The S&P Pan Asia Dividend Aristocrats has a 9.9% ROE versus 9.1% for the S&P Pan Asia BMI as of Dec. 29, 2023.

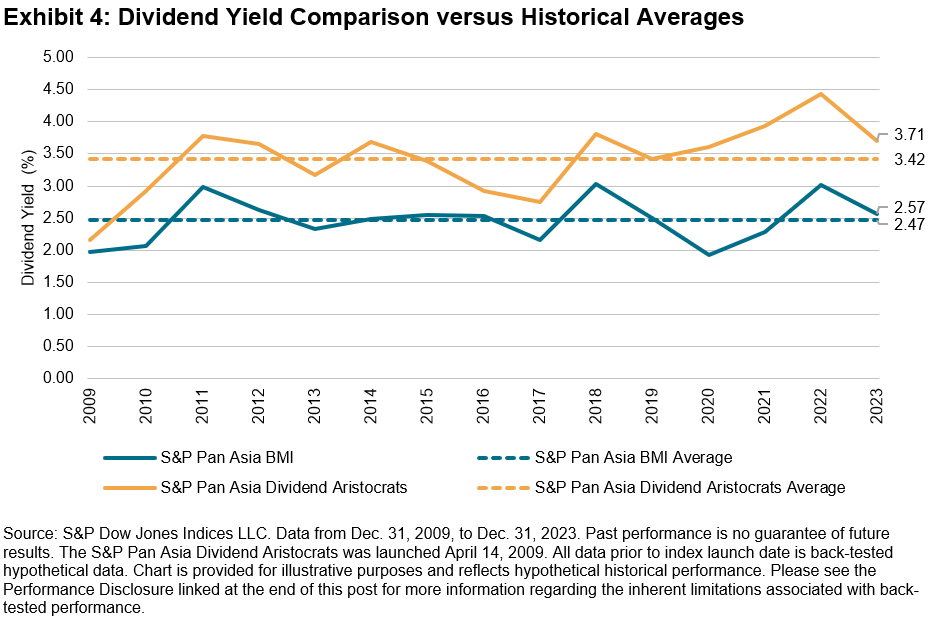

As Exhibit 4 reveals, the index’s dividend yield has been increased than the Pan Asia BMI’s dividend yield yearly since 2009. Moreover, the common dividend yield for the S&P Pan Asia Dividend Aristocrats was 3.42% versus 2.47% for the S&P Pan Asia BMI over this era. Apparently, the year-end 2023 dividend yield for the S&P Pan Asia Dividend Aristocrats was 3.71%, 8.40% increased than its historic common versus the S&P Pan Asia BMI’s year-end 2023 dividend yield of two.57%, solely 4% increased than its historic common.

Conclusion

Following a robust 12 months of efficiency in 2023 due to its efficient bottom-up inventory choice, the S&P Pan Asia Dividend Aristocrats heads into 2024 holding a dividend yield and valuation benefit over its benchmark. For traders searching for an index with these worth and dividend yield exposures, along with numerous high quality and dividend filters, the S&P Pan Asia Dividend Aristocrats Index is an choice to contemplate.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

[ad_2]

Source link