[ad_1]

UK chancellor Jeremy Hunt failed to say the time period “local weather change” in any respect when setting out the federal government’s spring funds – the primary because it was confirmed that 2023 was Earth’s hottest yr on report.

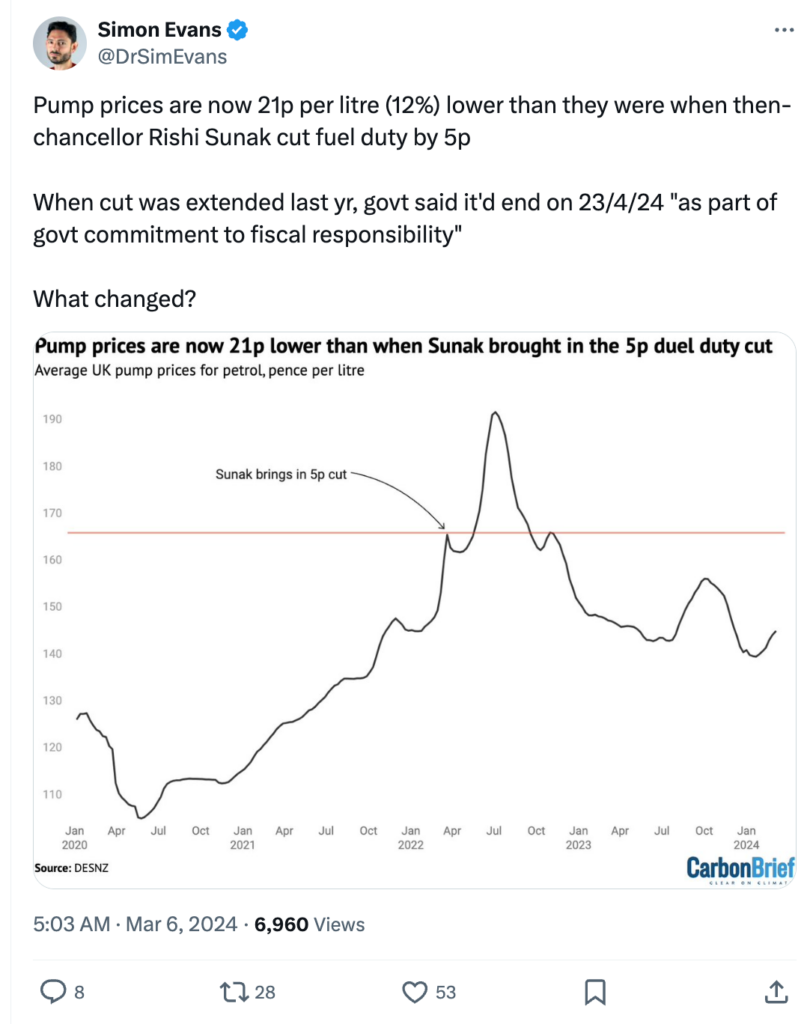

As anticipated, Hunt used his funds speech to announce that the federal government is freezing gas obligation on petrol and diesel for the 14th yr in a row.

As of 2023, this coverage had added as much as 7% to UK emissions, in accordance with earlier Carbon Transient evaluation.

The chancellor additionally introduced a year-long extension to the windfall tax on oil-and-gas corporations, however didn’t decide to spending the cash raised on new local weather investments.

Hunt didn’t supply any new insurance policies to assist increase the rollout of key low-carbon applied sciences, corresponding to electrical automobiles (EVs) and warmth pumps.

He additionally pledged no additional modifications to the federal government’s long-term regime of maximising oil and gasoline manufacturing.

General, regardless of some affirmation of additional funding for provide chains, analysts described the funds as a “missed alternative” for enhancing low-carbon industries and accelerating the transition away from fossil fuels within the UK.

Alongside the funds, the federal government additionally confirmed key particulars of its sixth public sale spherical for brand spanking new renewable vitality initiatives, together with a pot price simply over £1bn.

With a UK normal election on the horizon – and Labour having fun with a considerable lead within the polls – this funds is more likely to be Hunt’s final as chancellor.

Beneath, Carbon Transient runs by means of the important thing bulletins.

Gas obligation

The federal government has frozen gas obligation on petrol and diesel for the 14th yr in a row.

This persistent coverage quantities to a big tax lower, as gas obligation has dropped significantly in actual phrases through the years moderately than rising with inflation.

The freeze makes it cheaper to drive a automobile and reduces the inducement to make use of extra fuel-efficient fashions. As of 2023, Carbon Transient calculated that gas obligation freezes had elevated UK carbon dioxide (CO2) emissions by as much as 7%.

Hunt has additionally opted to retain an additional 5p lower in obligation, which was first launched in 2022 to deal with rising gas prices. This decreased the speed on petrol and diesel from 57.95p per litre to 52.95p.

Within the 2022 spring assertion, it was described as a brief measure. The federal government said the 5p lower would finish on 23 March 2024 “as a part of the federal government’s dedication to fiscal accountability and making certain belief and confidence in our nationwide funds”.

Nonetheless, Hunt introduced that it’s going to stay in place for one more yr. That is regardless of gas costs now being comfortably decrease than they had been through the vitality disaster.

These two measures have been a significant drain on public funds.

Collectively, they may price the Treasury £3.1bn in 2024-25, with a cumulative price of round £90bn since 2010, in accordance with official figures launched by the Workplace for Finances Accountability.

Evaluation carried out by the Social Market Basis (SMF) within the run as much as the spring funds locations the cumulative determine far greater, at £130bn.

The thinktank provides that the price of sustaining gas obligation freezes would rise to greater than £200bn by 2030 – “sufficient to fund your entire NHS for a yr”.

With the federal government underneath strain from the correct of the Conservative social gathering and the right-leaning press to chop taxes, the fuel-duty freeze was trailed within the Occasions forward of the funds as one of many “two major tax cuts” deliberate by the chancellor, together with a discount in nationwide insurance coverage.

The Solar claimed accountability for Hunt’s continued gas obligation freeze, because of the newspaper’s long-standing “Maintain It Down” marketing campaign, which it runs with the climate-sceptic lobbyist and Reform Occasion London mayoral candidate Howard Cox. A current Solar editorial said:

“Seven Tory chancellors have cursed us for it. To them it has ‘price’ £90bn in tax they’d like to have spent.”

As an alternative, the Solar factors to the advantages for “British motorists”. Professional-motoring lobbyists have argued {that a} fuel-duty lower is a vital bulwark towards the “conflict on motorists” happening within the UK. The federal government has absorbed this message, with prime minister Rishi Sunak asserting final yr he was “slamming the brakes on the conflict on motorists”.

The federal government describes its gas obligation freeze as a part of its efforts to “help folks with the price of residing”.

The opposition Labour Occasion has additionally backed the fuel-duty freeze on these grounds. Final yr, shadow chancellor Rachel Reeves threw her weight behind it to assist the “many households and companies reliant on their vehicles”.

But evaluation by the SMF reveals that, regardless of rhetoric that emphasises advantages for abnormal, hard-working folks, fuel-duty cuts disproportionately profit wealthier folks. It’s because they’re extra more likely to personal vehicles and the vehicles they personal usually tend to be much less fuel-efficient fashions, corresponding to SUVs.

Because of this, the thinktank says sustaining the 2022 fuel-duty lower will save the UK’s richest folks round thrice as a lot cash because the nation’s poorest.

Furthermore, evaluation by the RAC Basis on the finish of 2023 discovered that the federal government’s cuts to gas costs had not all been handed onto customers. As an alternative, it concluded that fossil-fuel retailers had stored financial savings from decrease wholesale prices for themselves, leaving drivers “paying 10p [per litre] greater than they need to be”.

In the meantime, the price of bus and coach fares has risen excess of the price of operating a automobile, as rail fares in England and Wales elevated by 5% this yr.

The SMF has proposed that funding in public transport can be a simpler method to save households cash.

Others have prompt that such investments is also a significant driver of financial progress. For instance, authorities advisors on the Nationwide Infrastructure Fee argued final yr that the UK ought to make investments £22bn in mass transit schemes exterior London within the coming years.

As an alternative, probably the most important public-transport coverage the federal government has launched in current months has been cancelling the northern leg of the HS2 practice line.

Again to prime

Air passenger obligation

Hunt additionally introduced a rise in air passenger obligation on “non-economy” passengers as a revenue-raising measure to assist pay for tax cuts elsewhere.

Because of this, these flying enterprise class, premium financial system, top notch or in non-public jets can pay a better value for aircraft tickets.

This coverage will elevate between £110m and £140m yearly from 2025 by means of to 2029, in accordance with authorities figures.

The funds doc explains that this can be a measure to convey air passenger obligation consistent with excessive inflation and keep its worth in actual phrases.

Nonetheless, it emphasises that for the 70% of passengers flying financial system, or on short-haul flights, “charges will stay frozen” with a view to “maintain the price of flying down”.

In reality, in 2021 when Sunak was chancellor, the federal government lower air passenger obligation in half for home flights, making air journey cheaper inside the UK. Reversing this modification would usher in an additional £69m to the Treasury, in accordance with the Marketing campaign for Higher Transport.

Campaigners have proposed a extra expansive “frequent flyer levy” with a view to actively discourage flying and lower emissions from aviation, which accounts for round 3% of UK emissions.

In accordance with New Economics Basis modelling, this might have raised £4bn in revenues in 2022.

Because it stands, the federal government has no express plans to scale back demand for air journey within the UK. That is regardless of such plans being flagged repeatedly by authorities local weather advisors the Local weather Change Committee (CCC) as a lacking a part of the UK’s technique to achieve net-zero.

Again to prime

Windfall tax

Hunt used his funds to increase the windfall tax on North Sea oil and gasoline corporations by one other yr, bringing its scheduled finish date to March 2029.

This was regardless of opposition from Scottish Conservatives, in accordance with BBC Information – and the vitality secretary Claire Coutinho, in accordance with Politico.

He informed parliament this extension would elevate £1.5bn. Nonetheless, he didn’t say what this extra cash can be spent on.

He added that the “vitality earnings levy”, because the windfall tax is thought, can be abolished “ought to market costs fall to their historic norm for a sustained time period”.

In an announcement, Kate Mulvany, principal guide at consultancy Cornwall Perception, stated that the transfer “may very well be seen as constructive for decarbonisation if the ensuing earnings are used to ship the UK’s net-zero plan”, however added:

“But, and not using a strong transition technique away from the UK’s oil and gasoline dependence and no assurance that tax revenues will instantly help decarbonisation initiatives, the potential upheaval in funding may outweigh the advantages.”

Forward of the funds, each the Occasions and Bloomberg reported that the tax extension was being described as one of many measures that might assist fund Hunt’s 2p lower in nationwide insurance coverage.

Labour has additionally proposed extending the tax by a yr, if elected to energy, Politico reported. Moreover, Labour intends to boost the levy on oil-and-gas firm earnings from 75% to 78%. It has pledged to spend the cash raised on low-carbon investments.

Oil-and-gas commerce group Offshore Energies UK has known as the Labour proposal “alarming” and claimed that it may result in job losses within the sector. (See Carbon Transient’s factcheck of deceptive claims surrounding North Sea oil and gasoline.)

Elsewhere in his funds speech, Hunt didn’t decide to every other modifications on fossil-fuel funding insurance policies.

This was to the dismay of many environmental teams and vitality consultants, who had urged the chancellor to decide to new measures to finish reliance on oil and gasoline. In an announcement, Esin Serin, coverage fellow on the Grantham Analysis Institute on Local weather Change and the Surroundings, stated:

“The chancellor needs to be making extra of the tax system to drive the transition away from fossil fuels.”

Again to prime

Clear expertise

Hunt introduced that the federal government is shopping for two nuclear websites from Hitachi for £160m, in a transfer reportedly geared toward shortly delivering nuclear growth plans.

The websites are at Wylfa in Anglesey, Wales and Oldbury-on-Severn in South Gloucestershire. The choice follows a interval of uncertainty for Wylfa, after the closure of the earlier nuclear energy plant on the website in 2015.

Hitachi had deliberate to construct a brand new 2.9 gigawatt (GW) nuclear plant on the positioning for a reported £20bn. Nonetheless, the Japanese conglomerate introduced it was shelving the plans in 2019.

Moreover, Hunt introduced that the federal government has moved onto the following stage in its competitors to construct “small modular reactors” (SMRs). There are actually six corporations which have been invited to submit their preliminary tender responses by June.

The chancellor confirmed a £120m improve in funding for the “inexperienced industries progress accelerator” (GIGA), a fund designed to help the growth of ”robust and sustainable clear vitality provide chains” within the UK. The rise was introduced earlier this week.

This may convey the overall quantity within the fund to £1.1bn, in accordance with the funds paperwork, up from £960m introduced within the autumn assertion in November.

GIGA is designed to help carbon seize, utilization and storage (CCUS), engineered greenhouse gasoline removals (GGRs) and hydrogen, offshore wind and electrical energy networks, in addition to civil nuclear energy.

The fund can be break up between these sectors, with round £390m earmarked for electrical energy networks and offshore wind provide chains, and round £390m earmarked for CCUS and hydrogen, the treasury’s be aware said.

In January, the Division for Vitality Safety and Web Zero introduced £300m can be used to fund the manufacturing of a kind of nuclear gas generally known as “high-assay low-enriched uranium” (HALEU). Presently, Russia is the one producer of HALEU, so the home manufacturing plan is designed to assist finish “Russia’s reign”, the federal government states, in addition to to help the UK’s wider plans to ship “as much as” 24GW of nuclear energy by 2050.

In an announcement, commerce affiliation RenewableUK’s chief government Dan McGrail stated:

“The rise in GIGA funding to safe additional non-public funding in inexperienced manufacturing jobs will allow us to produce extra items and providers to initiatives right here and overseas. It’s additionally good to see that almost £400m of that funding can be used particularly to develop our offshore wind provide chain and electrical energy networks.”

Moreover, earlier this week the federal government trailed £360m for manufacturing initiatives and for analysis and improvement. This consists of nearly £73m in mixed authorities and trade funding within the improvement of electrical automobile (EV) expertise.

This can be supported by greater than £36m of presidency funding awarded by means of the UK’s “superior propulsion centre”, the Treasury notes, together with 4 initiatives which might be creating applied sciences for battery EVs.

Again to prime

Renewable public sale funds

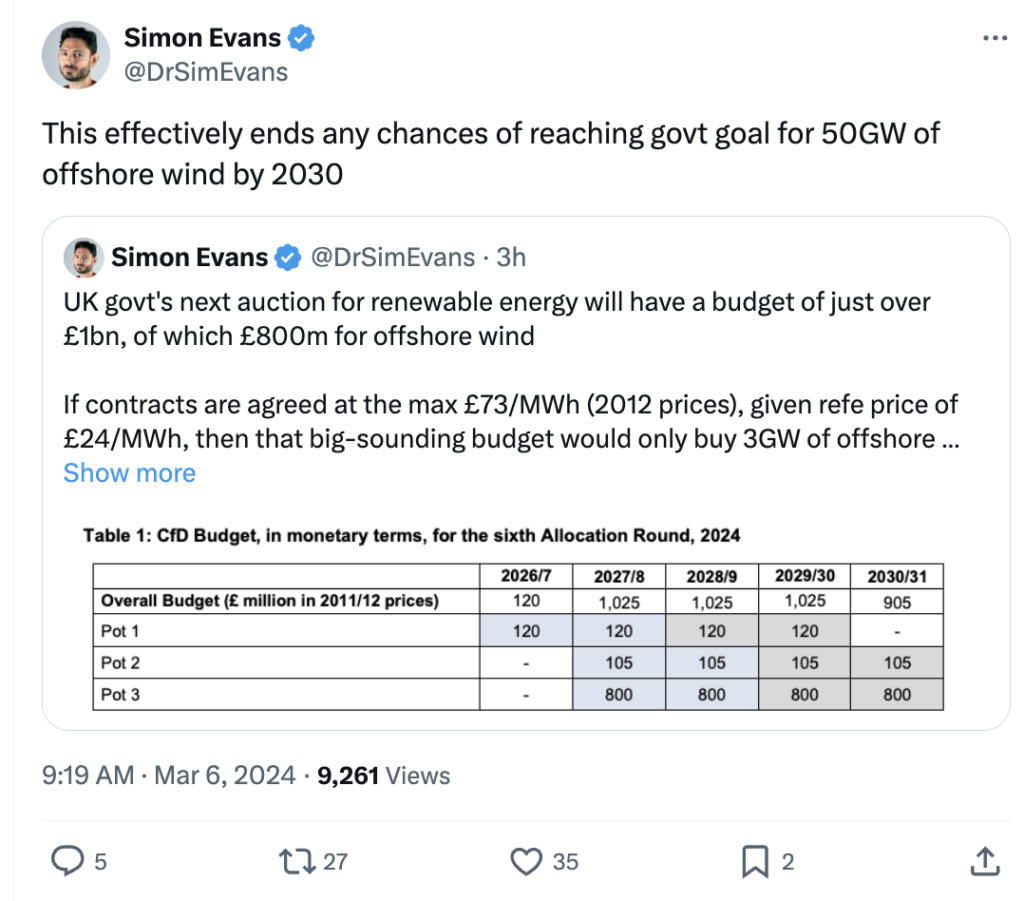

Alongside the funds, the federal government additionally confirmed key particulars of its sixth public sale (AR6) spherical for brand spanking new renewable vitality initiatives, together with a pot price simply over £1bn.

This follows final yr’s fifth public sale spherical, which didn’t safe any new offshore wind initiatives for the primary time.

The funds paperwork stated the £1bn funds for AR6 is the “largest ever” and consists of £800m particularly for offshore wind.

If profitable initiatives bid on the most value for offshore wind introduced final yr of £73 per megawatt hour (MWh) in 2012 costs, then the £800m funds would solely be adequate to safe simply 3GW of latest capability, Carbon Transient evaluation reveals.

Nonetheless, consultancy LCP Delta stated it may very well be adequate to safe 4-6GW of latest capability, implying that it assumes profitable initiatives will bid at costs round £50-60/MWh. In an announcement, it added:

“That is definitely a welcome improvement given final yr’s failed public sale. Nonetheless, it might not be sufficient to get the UK again on observe with time operating out to construct the extra 23GW wanted [to meet its 50GW target] by 2030.”

Equally, commerce affiliation Vitality UK says the public sale pot may safe 3-5GW of latest offshore wind, relying the place challenge bid costs sit in a spread of £55-£70/MWh.

The federal government has a goal of constructing 50GW of offshore wind by 2030. There may be at the moment round 15GW in operation and one other 14GW both underneath building, awarded a contract or having already taken a ultimate funding determination, notes Vitality UK.

This implies one other 21GW of latest capability can be wanted to hit the 50GW by 2030 goal, implying a necessity for at the very least 10GW in every of the following two public sale rounds, in accordance with the trade physique.

New evaluation produced by the physique following the funds means that the AR6 parameters make it unlikely the public sale will hit the extent of capability required, leaving a shortfall of at the very least 16GW, which might be “extraordinarily troublesome” to fill in AR7 alone.

Along with the £800m pot for offshore wind, the federal government has confirmed the upcoming public sale will embody as much as £105m for “pot two” applied sciences together with onshore wind, photo voltaic, vitality from waste with mixed warmth and energy and others, in addition to £120m for “pot three” applied sciences together with floating offshore wind, geothermal, tidal stream, wave and others.

Inside the CfD announcement and the spring funds, the federal government notes that it’s “making progress” on the community reforms introduced finally yr’s autumn assertion.

This consists of publishing a session on a brand new accelerated planning service for industrial grid functions, which has come on account of a earlier session on operational reforms to the nationally important infrastructure challenge regime. The federal government has additionally up to date its nationwide networks nationwide coverage assertion.

Moreover, for the reason that autumn assertion final November, over 40GW of vitality initiatives have been provided earlier grid connection dates, the funds states. This accelerates as much as £40bn in funding.

To additional assist grid connections, Nationwide Grid Electrical energy System Operator is inserting supply milestones into over 1,000 connection contracts, in an effort to take away stalled initiatives from the grid connection queue from this coming autumn, the funds notes.

Susanna Elks, E3G senior coverage Advisor for the UK electrical energy transition at thinktank E3G stated the reforms to electrical energy networks and “beefed-up funds” for the CfD suggests the Conservatives “can’t ignore that low-cost renewables are the expansion engine of the long run”. She provides:

“Whereas as we speak’s announcement is welcome, the UK nonetheless lacks an overarching plan to create a clear low-cost electrical energy system– with a failure to supply help for hydrogen-to-power, long-term storage and demand aspect flexibility. These are key applied sciences which may assist finish our dependancy to costly polluting gasoline, whereas decreasing payments for customers.”

Again to prime

Electrical vehicles

Forward of the funds, an open letter by the motoring foyer group FairCharge known as on the chancellor to finish the upper charges of VAT on public electrical automobile charging, when in comparison with house charging.

Individuals who cost their EVs at house solely pay 5% VAT on their payments, however the 38% of the inhabitants with out driveways who must use public chargers pay the complete VAT price of 20%, presenting a “charging injustice”, the group informed the Day by day Mirror.

The Society of Motor Producers and Merchants additionally known as for VAT on public EV charging factors to be lower, to be consistent with the VAT on house charging factors.

Talking to the Occasions, Mike Hawes, chief government of the group, stated that prime VAT charges on public charging factors had been a part of a “triple tax barrier” to extra non-public possession of EVs.

He additionally urged the chancellor to reverse proposed excise obligation modifications that deal with upmarket electrical vehicles as luxuries moderately than necessities, growing automobile taxes by as much as £2,000, and to chop the 20% VAT that new automobile consumers should pay on new EVs.

Nonetheless, through the funds, Hunt didn’t point out any new measures to spice up EVs.

Sharelines from this story

[ad_2]

Source link